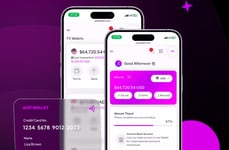

Clear Junction Launches New E-Wallet to Make Opening Banking Simpler

Niko Pajkovic — May 13, 2022 — Tech

References: thefintechtimes

UK-based payments solutions company Clear Junction has announced the launch of its new e-wallet, which has been designed specifically for open banking providers.

The new digital wallet aims to address a common problem for open banking services: payment initiation service (PIS) licenses are difficult to come by and typically do not allow banking providers to hold merchants' cash. As a result, merchants are forced to sign two separate agreements, one with an opening banking provider and the other with a payments solutions firm.

However, with Clear Junction's new e-wallet, opening banking providers will be able to integrate payment solutions into their platform, providing merchants with a simple one-stop-shop platform for conducting business.

“Through our new e-wallet offering, open banking providers are able to enhance their customer offering, making the entire process of sending and receiving funds quick and easy," explained Berivan Demir, product and banking relationship director at Clear Junction.

Image Credit: Clear Junction

The new digital wallet aims to address a common problem for open banking services: payment initiation service (PIS) licenses are difficult to come by and typically do not allow banking providers to hold merchants' cash. As a result, merchants are forced to sign two separate agreements, one with an opening banking provider and the other with a payments solutions firm.

However, with Clear Junction's new e-wallet, opening banking providers will be able to integrate payment solutions into their platform, providing merchants with a simple one-stop-shop platform for conducting business.

“Through our new e-wallet offering, open banking providers are able to enhance their customer offering, making the entire process of sending and receiving funds quick and easy," explained Berivan Demir, product and banking relationship director at Clear Junction.

Image Credit: Clear Junction

Trend Themes

1. Open Banking Integration - Developing seamless digital wallets that integrate open banking features provide a simpler and faster way for conducting business transactions.

2. Streamlined Payment Processing - Creating e-wallets that allow merchants to handle payment processing easily can revolutionize the payments industry and improve overall customer experience.

3. Collaborative Partnerships - Encouraging partnerships between payment solutions and open banking providers can foster disruptive innovation opportunities and steer advancements in the payments market.

Industry Implications

1. Payments Solutions - By offering accessible, fast, and affordable payment processing solutions, payment solutions firms can stand out among the competition and address the needs of merchants.

2. Open Banking Providers - Incorporating e-wallets and other cutting-edge fintech innovations can help open banking providers improve customer experience and gain a competitive edge.

3. Fintech - Innovative fintech companies can create secure and user-friendly e-wallets and payment solutions that can benefit both open banking providers and merchants.

3.8

Score

Popularity

Activity

Freshness