Banking apps for freelancers help streamline their personal finances

Trend - Freelancing requires a lot of organization, including being able to keep track of projects, payments, and contacts. In order to streamline freelancing work, some brands offering platforms to that help users' organize their work. This now includes banking and financing services.

Insight - With remote work and freelancing booming, consumers who work within the gig economy require consistent organization and project management in order to ensure that their income remains consistent. These individuals turn to platforms that help them streamline their work in order to get the most out of it.

Insight - With remote work and freelancing booming, consumers who work within the gig economy require consistent organization and project management in order to ensure that their income remains consistent. These individuals turn to platforms that help them streamline their work in order to get the most out of it.

Workshop Question - How could your brand better cater to its customers' lifestyles?

Trend Themes

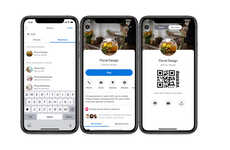

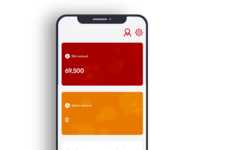

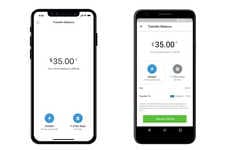

1. Banking Apps for Freelancers - With the rise of remote work and freelancing, organizations are creating banking apps for professionals that cater to their specific needs such as helping them manage their finances, divide funds and automatically allocate them.

2. Integrated Lifestyle Banking Apps - Banking apps are going beyond just financial services and incorporating other lifestyle features such as daily expenditure tracking, booking taxis, creating itemized lists, and more for a better user experience.

3. Travel-focused Credit Cards - Credit cards are targeting younger consumers with no fees, no interest and no credit inquiries while offering cashback programs for specific retailers or brands such as Selina, a lifestyle and hospitality brand targeting Gen Z and Millennial travelers.

Industry Implications

1. Banking and Finance - As freelancers and remote workers continue to rise, banking institutions can innovate with tailored services for niche segments that better caters to their needs and streamline efficiency such as with automatic funds allocation.

2. Technology - With the development of banking apps that cater to lifestyle needs such as tracking expenses or booking taxis, technology companies can collaborate with banks and disrupt traditional banking to deliver more valuable user experiences.

3. Travel and Hospitality - Travel-focused credit cards that reward consumers for engaging with specific brands or retailers offer hotels and other travel businesses the opportunity to partner and integrate rewards into a customer's overall travel experience.