The J.P. Morgan Reserve Credit Card is Ultra-Exclusive

Michael Hemsworth — July 1, 2021 — Lifestyle

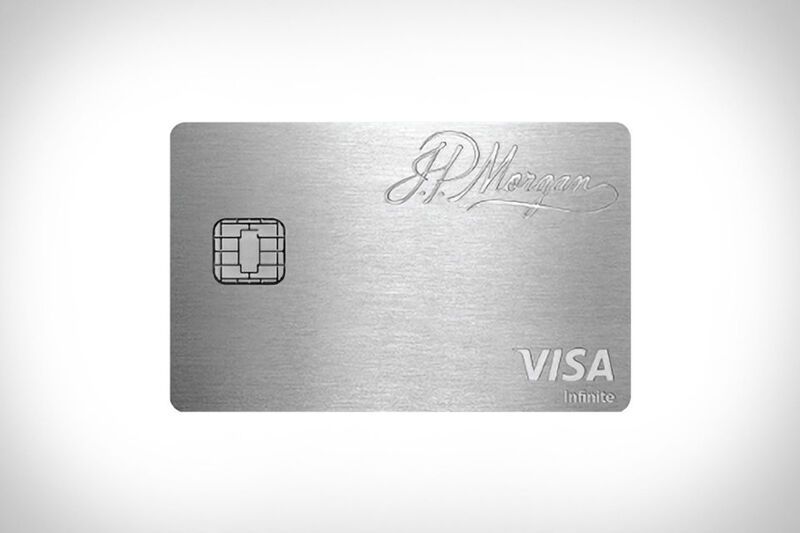

The J.P. Morgan Reserve credit card is an ultra-exclusive card from the bank that's focused on providing discerning consumers with a product that is in line with their lifestyle. The invitation-only credit card is reserved for banking members who have at least $10-million in investible assets and features a 28-gram weight that is achieved with palladium construction. This positions the card as the heaviest mainstream credit card available to make its presence known in the hand of the owner as well as anyone performing the transaction.

The J.P. Morgan Reserve credit card comes with a range of benefits for subscribers to take advantage of including a $300 annual travel credit along with three-times the points on travel purchases, Priority Pass Select membership and more.

The J.P. Morgan Reserve credit card comes with a range of benefits for subscribers to take advantage of including a $300 annual travel credit along with three-times the points on travel purchases, Priority Pass Select membership and more.

Trend Themes

1. Ultra-exclusive Credit Cards - The rise of invitation-only credit cards represents a potential opportunity for financial institutions to cater to high net-worth individuals and promote exclusivity and luxury as part of the brand identity.

2. Premium Credit Card Rewards Programs - The creation of exclusive reward programs for high-end credit cards can enable financial institutions to incentivize higher transaction volumes among their target market and retain affluent consumers.

3. Luxury Credit Card Branding - Financial institutions can leverage the ultra-premium attributes and unique branding of niche credit card products to create differentiation in the marketplace and appeal to discerning consumers.

Industry Implications

1. Financial Services - The invitation-only credit card market represents a disruptive opportunity for traditional financial institutions to cater to niche, high-value segments of the market with specialized credit card offerings.

2. Luxury Goods - With the emergence of ultra-exclusive credit cards, luxury retailers can collaborate with financial institutions to offer joint-branding initiatives and premium lifestyle benefits to high net-worth customers.

3. Loyalty Programs - As financial institutions increasingly use exclusive reward programs as a competitive differentiator, the loyalty program space presents a disruptive opportunity for fintech companies to leverage blockchain technology and decentralized platforms to create innovative value propositions for affiliated brands and consumers alike.

3.5

Score

Popularity

Activity

Freshness