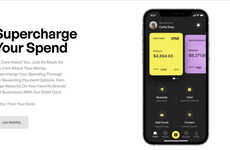

The 'Point' Mobile Banking App Doesn't Require a Credit Card

Michael Hemsworth — December 10, 2019 — Lifestyle

Points and perks are often used by credit card providers to provide a reward for consumers, so the 'Point' mobile banking app is positioned as a new solution to do just that without having to accumulate any debt in the process. The app is a debit card that will provide shoppers with points for making purchases through their favorite merchants and brands. This includes such companies as DoorDash, Uber, Chipotle, Starbucks and many more.

The 'Point' mobile banking app will reward users for saving with a 1.4% APY and also provide them with FDIC insurance as well as a no hidden fee model for them to appreciate. The service will come as welcome news to consumers seeking to perform a financial makeover and shift their purchases away from credit cards.

The 'Point' mobile banking app will reward users for saving with a 1.4% APY and also provide them with FDIC insurance as well as a no hidden fee model for them to appreciate. The service will come as welcome news to consumers seeking to perform a financial makeover and shift their purchases away from credit cards.

Trend Themes

1. Mobile Banking - Disruptive innovation opportunity: Develop a mobile banking app that rewards users for savings and offers no hidden fees.

2. Points-based Rewards - Disruptive innovation opportunity: Create a points-based rewards program for debit card users to encourage loyalty and repeat purchases.

3. Debt-free Shopping - Disruptive innovation opportunity: Introduce a debit card app that allows users to earn points and perks without accumulating debt.

Industry Implications

1. Fintech - Disruptive innovation opportunity: Innovate within the financial technology industry to create new mobile banking solutions.

2. Consumer Rewards - Disruptive innovation opportunity: Disrupt the consumer rewards industry by offering points-based programs for debit card users.

3. Payment Processing - Disruptive innovation opportunity: Rethink payment processing by creating a debit card app that incentivizes debt-free shopping.

3.4

Score

Popularity

Activity

Freshness