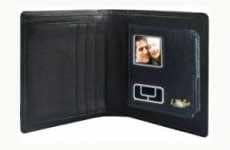

Mobile credit card apps allow for convenient payment and thinner wallets

Implications - Providing shoppers with a convenient means of carrying a thin wallet while shopping, tech and social media businesses are creating apps to replace the numerous credit cards that often take up too much room in an individual’s pockets. With society’s movement towards a world that’s more virtual-based, these non-tactile payment methods will surely increase in popularity with time.

Trend Themes

1. Virtual Wallets - The increasing popularity of virtual wallets is an opportunity for businesses to provide efficient ways to organize clients' information.

2. Mobile Phone Payments - Mobile payment systems such as Google Wallet and Square offer no-contract, low-cost alternatives for businesses to accept payments with ease and convenience.

3. Non-tactile Payment Methods - The shift towards non-tactile payment methods presents an opportunity for businesses to cater to customers who prefer contactless options, particularly in the wake of the COVID-19 pandemic.

Industry Implications

1. Fintech - Fintech companies should innovate solutions that optimize mobile payments experience and integrate with virtual wallets.

2. Retail - Retailers can take advantage of mobile payment and virtual wallet technology to create seamless checkout experiences for customers.

3. Hospitality - Hotels, restaurants, and cafes can adopt non-tactile methods of payment such as mobile phone payments and QR code scans to offer customers a safer and more convenient experience.

4 Featured, 29 Examples:

380,589 Total Clicks

Date Range:

Dec 09 — Jun 11

Trending:

Warm

Consumer Insight Topics: