Twitpay Lets You Send Money Via Tweet

Marissa Brassfield — December 19, 2008 — Business

References: twitpay.me & bits.blogs.nytimes

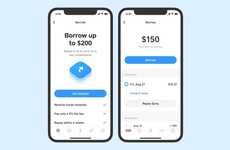

Twitpay is a micropayment startup that aims to essentially Twitterfy PayPal payments, in so many words. Users first must create a Twitpay account and then fund it using an online payment site like PayPal.

Next, they'd post a Twitter update that includes the username of the recipient. An example tweet might look like this: "@trendhunter twitpay $5 for being awesome." The money is then transferred from your Twitpay account to your recipient's, and the transaction is completed.

Here's where things get fuzzy. After you've amassed at least $10 in your Twitpay account, you're welcome to withdraw it--in the form of an Amazon gift card. No cash withdrawals here. And for each transaction over $1, Twitpay takes out a 5-cent fee.

The start-up is controversial at best, but it does pose a curious insight into consumer desire to simplify the way they send money online.

Next, they'd post a Twitter update that includes the username of the recipient. An example tweet might look like this: "@trendhunter twitpay $5 for being awesome." The money is then transferred from your Twitpay account to your recipient's, and the transaction is completed.

Here's where things get fuzzy. After you've amassed at least $10 in your Twitpay account, you're welcome to withdraw it--in the form of an Amazon gift card. No cash withdrawals here. And for each transaction over $1, Twitpay takes out a 5-cent fee.

The start-up is controversial at best, but it does pose a curious insight into consumer desire to simplify the way they send money online.

Trend Themes

1. Micropayments - Disruptive innovation opportunity: Explore new ways of facilitating small transactions and making online payments more convenient.

2. Twitter-based Payments - Disruptive innovation opportunity: Develop platforms that leverage social media channels like Twitter for secure and seamless financial transactions.

3. Alternative Payment Methods - Disruptive innovation opportunity: Investigate and capitalize on emerging payment solutions that offer alternatives to traditional cash or card transactions.

Industry Implications

1. Fintech - Disruptive innovation opportunity: Embrace technological advancements and disrupt the traditional financial industry by creating innovative payment solutions.

2. Social Media - Disruptive innovation opportunity: Combine the power of social media networks with secure financial transactions to provide users with new ways to send and receive money.

3. E-commerce - Disruptive innovation opportunity: Improve e-commerce platforms by integrating user-friendly micropayment options that enhance the customer experience.

1.2

Score

Popularity

Activity

Freshness