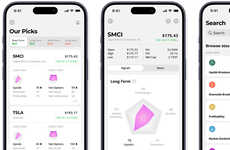

AI brands introduce tools to optimize hedge fund management

Trend - AI brands are launching hedge fund assistants powered by advanced algorithms and machine learning. These tools are designed to analyze vast datasets, optimize trading strategies, and provide predictive insights, while aiming to improve efficiency and offer an edge in the hedge fund management.

Insight - Hedge fund managers face increasing pressure to deliver superior returns while navigating complex markets. The demand for tools that can process large volumes of data and uncover actionable insights has grown significantly. Additionally, the need for real-time analysis and adaptive strategies has driven the adoption of AI-powered assistants. These tools cater to the desires of hedge fund managers for precision, efficiency, and innovation, while staying competitive in a data-driven industry.

Insight - Hedge fund managers face increasing pressure to deliver superior returns while navigating complex markets. The demand for tools that can process large volumes of data and uncover actionable insights has grown significantly. Additionally, the need for real-time analysis and adaptive strategies has driven the adoption of AI-powered assistants. These tools cater to the desires of hedge fund managers for precision, efficiency, and innovation, while staying competitive in a data-driven industry.

Workshop Question - How can your brand leverage advanced data analysis and machine learning to enhance decision-making and efficiency in your industry?

Trend Themes

1. AI-driven Hedge Fund Optimization - Advancements in AI technology are revolutionizing hedge fund strategies by enabling real-time data analysis, predictive modeling, and actionable insights.

2. Personalized AI Financial Advisory - AI-powered platforms are transforming financial advisory by offering hyper-personalized, data-driven recommendations that surpass traditional models.

3. Real-time Financial Data Integration - The integration of AI with real-time financial data is enhancing investment decision-making by providing investors with immediate access to comprehensive market analyses.

Industry Implications

1. Financial Technology - FinTech is experiencing a transformation as AI and data science enable innovative solutions for financial management and investment optimization.

2. Investment Management - AI-driven tools are disrupting the investment management landscape by increasing efficiency and accuracy in trading and portfolio management.

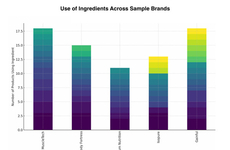

3. Data Analytics - The rise of AI in data analytics is offering unprecedented capabilities in processing and interpreting large datasets for strategic business decisions.

4 Featured, 35 Examples:

18,787 Total Clicks

Date Range:

Oct 23 — Mar 25

Trending:

This Year and Warm

Consumer Insight Topics: