TotallyMoney and Bud Financial Launch an AI-Powered Payments Tracker

References: totallymoney & finextra

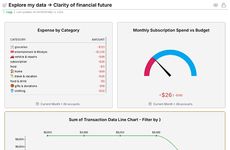

TotallyMoney has teamed up with data intelligence platform Bud Financial (Bud) to introduce an innovative service that empowers consumers to control their finances using AI models and real-time open banking data.

By leveraging Bud's advanced AI capabilities, TotallyMoney hopes to provide its customers with predictive insights and proactive bill and payment tracking. Customers can securely share their financial data through open banking, enabling Bud's AI-trained models to analyze months of spending at once. This analysis identifies regular payments, such as utility bills, subscriptions, and rent, and generates a dynamic breakdown of upcoming payments.

By utilizing Bud's data intelligence services, TotallyMoney seeks to assist its customers in building, improving, and safeguarding their credit scores. By anticipating payments and expenses, consumers can plan to stay on top of their bills and prevent stress.

Image Credit: khunkornStudio

By leveraging Bud's advanced AI capabilities, TotallyMoney hopes to provide its customers with predictive insights and proactive bill and payment tracking. Customers can securely share their financial data through open banking, enabling Bud's AI-trained models to analyze months of spending at once. This analysis identifies regular payments, such as utility bills, subscriptions, and rent, and generates a dynamic breakdown of upcoming payments.

By utilizing Bud's data intelligence services, TotallyMoney seeks to assist its customers in building, improving, and safeguarding their credit scores. By anticipating payments and expenses, consumers can plan to stay on top of their bills and prevent stress.

Image Credit: khunkornStudio

Trend Themes

1. Predictive Financial Insights - The integration of AI models and real-time open banking data allows for predictive insights and proactive bill and payment tracking.

2. Dynamic Payment Breakdown - AI-trained models analyze months of spending to generate a dynamic breakdown of upcoming payments, including regular expenses.

3. Credit Score Protection - By anticipating payments and expenses, consumers can plan to stay on top of their bills and improve their credit scores.

Industry Implications

1. Personal Finance - AI-powered finance trackers offer consumers a comprehensive solution to manage their personal finances and improve their financial well-being.

2. Data Intelligence - The combination of AI capabilities and real-time open banking data provides opportunities to leverage data intelligence for financial analysis and tracking.

3. Fintech - The integration of AI-powered finance trackers disrupts the traditional financial services industry by offering innovative and personalized solutions to consumers.

5.9

Score

Popularity

Activity

Freshness