PortfolioPilot uses AI to Analyze Individuals' Economic Profiles

Colin Smith — May 6, 2024 — Tech

References: portfoliopilot & foxbusiness

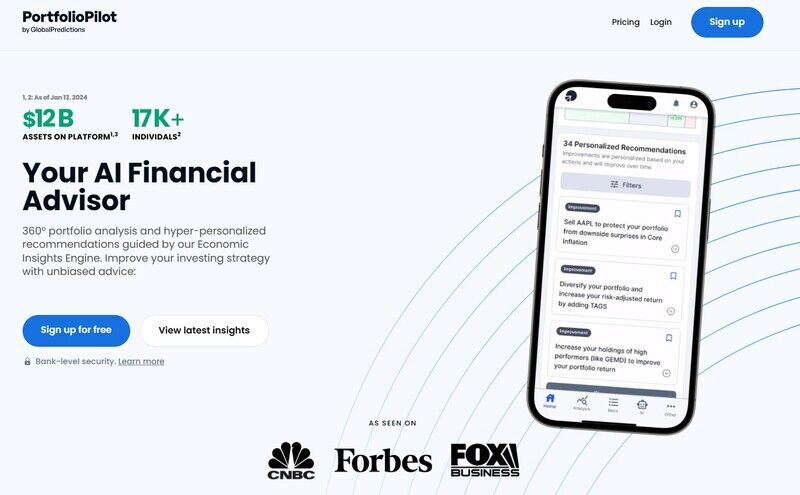

PortfolioPilot, developed by Global Predictions, is proclaimed to be the first AI financial advisor to receive regulatory approval from the SEC. PortfolioPilot offers a unique value proposition that sets it apart from traditional robo-advisors and human financial consultants. The platform is designed to provide truly personalized advice, taking into account an individual’s complete financial picture, including assets like real estate, investment goals, and risk tolerance. The AI utilizes a proprietary Recommendation Engine backed by an Economic Insights model, employing a Hybrid-ML approach for generating financial analyses. This sophisticated system is capable of parsing, summarizing, and organizing financial data to facilitate user interaction, ensuring that the financial advice provided is not only personalized but also based on rigorous economic models.

In terms of security and accessibility, PortfolioPilot prioritizes user safety with 256-bit encrypted bank-level security and supports connections to over 12,000 financial institutions, including banks, brokerages, and crypto wallets. The platform’s AI assistant is available 24/7 to answer investment-related queries, offering portfolio assessments and macroeconomic insights.

With a subscription model starting at $29 per month, users can access personalized recommendations guided by hedge fund-inspired economic models. As of early 2024, PortfolioPilot is utilized by thousands of individuals, managing over $12 billion in assets, indicating a strong trust and reliance on the platform for financial management and investment strategy optimization.

Image Credit: GlobalPredictions

In terms of security and accessibility, PortfolioPilot prioritizes user safety with 256-bit encrypted bank-level security and supports connections to over 12,000 financial institutions, including banks, brokerages, and crypto wallets. The platform’s AI assistant is available 24/7 to answer investment-related queries, offering portfolio assessments and macroeconomic insights.

With a subscription model starting at $29 per month, users can access personalized recommendations guided by hedge fund-inspired economic models. As of early 2024, PortfolioPilot is utilized by thousands of individuals, managing over $12 billion in assets, indicating a strong trust and reliance on the platform for financial management and investment strategy optimization.

Image Credit: GlobalPredictions

Trend Themes

1. PERSONALIZED Financial Advice - Disruptive innovation opportunity lies in leveraging AI to offer tailored financial advice based on individual financial profiles.

2. ENCRYPTED Data Security - Exploring advancements in data encryption can lead to enhanced security measures for financial platforms handling sensitive information.

3. Subscription-based Models - Opportunities exist in adopting subscription-based models for financial services to offer cost-effective personalized recommendations.

Industry Implications

1. Financial Services - Financial firms can explore integrating AI-powered solutions to enhance customer experience and provide more personalized financial advice.

2. Cybersecurity - The cybersecurity industry can innovate by developing robust encryption methods to safeguard sensitive financial data in digital platforms.

3. Fintech - Fintech companies can disrupt the industry by offering subscription-based financial advisory services powered by AI for a wider audience.

8.4

Score

Popularity

Activity

Freshness