IAESIR Responds to Uncertainty with New Updates to Its Platform

References: iaesirfinance & accessnewswire

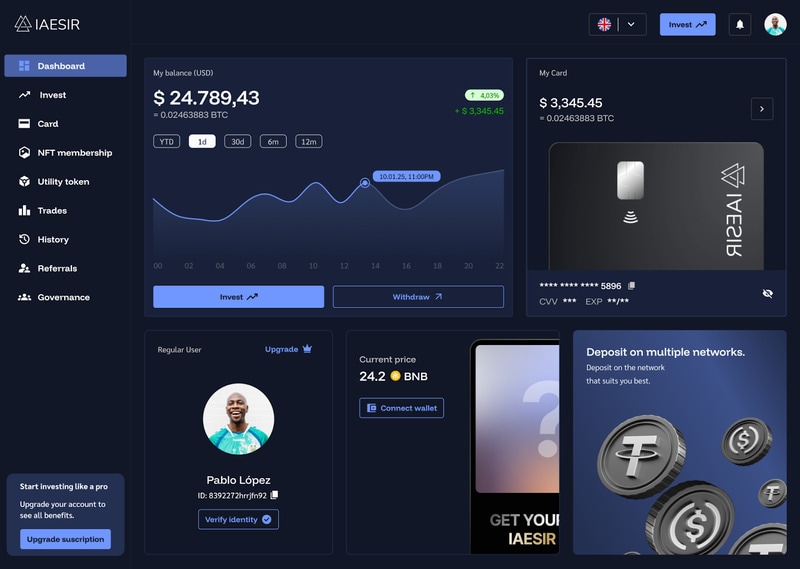

IAESIR has unveiled significant updates to its AI-powered hedge fund platform. The company aims to provide investors with more robust tools for navigating volatile financial markets.

The revamped AI-powered hedge fund platform introduces advanced security measures, improved AI-driven analytics, and enhanced compliance features. Key updates include proprietary AI infrastructure for secure data processing and transaction management, as well as structured asset allocation strategies to mitigate risks associated with market fluctuations.

The platform also plans to launch an IAESIR credit card, in order to enable users to access credit backed by their digital asset holdings and integrate these assets into everyday financial activities. These developments reflect IAESIR’s commitment to innovation, regulatory alignment, and expanding the practical applications of digital assets for its users.

Image Credit: IAESIR

The revamped AI-powered hedge fund platform introduces advanced security measures, improved AI-driven analytics, and enhanced compliance features. Key updates include proprietary AI infrastructure for secure data processing and transaction management, as well as structured asset allocation strategies to mitigate risks associated with market fluctuations.

The platform also plans to launch an IAESIR credit card, in order to enable users to access credit backed by their digital asset holdings and integrate these assets into everyday financial activities. These developments reflect IAESIR’s commitment to innovation, regulatory alignment, and expanding the practical applications of digital assets for its users.

Image Credit: IAESIR

Trend Themes

1. Advanced AI-driven Analytics - The deployment of sophisticated AI analytics in hedge fund platforms represents a disruption in financial decision-making by enabling more accurate market predictions.

2. Enhanced Security Measures - Implementing advanced security protocols within AI-driven investment platforms challenges traditional risk management by offering heightened data and transaction safety.

3. Digital Asset Integration - The integration of digital assets into routine financial transactions via products like credit cards signifies a transformative shift in personal finance management.

Industry Implications

1. Fintech - Incorporating AI technology into fintech solutions demonstrates a groundbreaking opportunity to enhance service precision and user experience.

2. Data Security - Revolutionary developments in transaction data protection within AI platforms signify an advancement in countering cybersecurity threats.

3. Asset Management - The structuring of asset allocation with AI assistance in hedge funds is a novel approach to minimizing exposure during market volatility.

8.3

Score

Popularity

Activity

Freshness