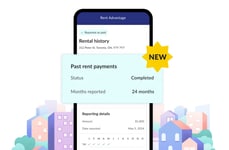

Companies create services that help consumers build credit by tracking rental payments

Trend - Banks and fintech companies are introducing services that help tenants report their rental payments to major credit bureaus like Equifax, Experian, and TransUnion. These services enable tenants to leverage their largest recurring expense—rent payments—to build or strengthen their credit profile.

Insight - Amidst rising costs, consumers seek tools to simplify credit building, especially as rent payments are often excluded from credit evaluations. Companies are recognizing the demand for rent reporting tools, as these services help tenants build or improve their credit scores by ensuring their payments are reported to major credit bureaus. These consumers understand that building credit doesn’t mean taking on more debt; instead, they leverage existing payments to strengthen their financial history.

Insight - Amidst rising costs, consumers seek tools to simplify credit building, especially as rent payments are often excluded from credit evaluations. Companies are recognizing the demand for rent reporting tools, as these services help tenants build or improve their credit scores by ensuring their payments are reported to major credit bureaus. These consumers understand that building credit doesn’t mean taking on more debt; instead, they leverage existing payments to strengthen their financial history.

Workshop Question - How does your brand consider its target consumers' estimated income?

Trend Themes

1. Credit Data Democratization - Expanding the inclusion of alternative financial data like rental payments into credit assessments is reshaping credit-building strategies and widening access for underserved consumers.

2. Financial Inclusion Tech - Innovative financial technologies are simplifying personal finance management by integrating diverse payment data into credit evaluations, enabling more individuals to benefit from enhanced financial opportunities.

3. Api-based Financial Solutions - Developers utilize API integrations to seamlessly embed financial tools like rental reporting into existing platforms, fostering a more robust and accessible credit ecosystem.

Industry Implications

1. Fintech - FinTech companies are at the forefront of providing digital solutions that democratize financial services and enhance credit visibility through advanced data integration.

2. Real Estate Technology - Real estate technology platforms are increasingly incorporating financial tools to help renters leverage payment histories as an asset in their credit profiles.

3. Consumer Credit Industry - The consumer credit industry is evolving with a growing emphasis on utilizing non-traditional data sources to create more comprehensive credit profiles and improve loan accessibility.

4 Featured, 28 Examples:

10,245 Total Clicks

Date Range:

Nov 23 — Jan 25

Trending:

This Year and Warm

Consumer Insight Topics: