Bloom Credit Unveils Credit-Building Tool for Renter Payment Data

References: bloomcredit.io & pymnts

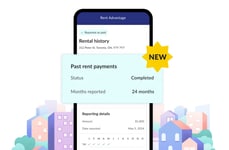

Bloom Credit, a financial wellness platform, has introduced a credit reporting service tailored to rental payment data. By incorporating rental payment data into credit profiles, the company hopes that individuals can benefit from a comprehensive credit history that better reflects their financial behavior.

This service enables rental apps to report rent payments to the three major credit bureaus to help consumers bolster their credit scores. The goal of this service is to provide individuals with limited credit history the opportunity to establish a more robust credit profile. This move aligns with the broader trend of financial services becoming more accessible and inclusive, as it enables individuals to use their rental payment history as a means to strengthen their creditworthiness.

“In today’s financial landscape, credit history plays a pivotal role in determining an individual’s access to affordable credit,” the company said in the release. “Unfortunately, a significant portion of consumers, especially those who rent their homes, have been left without a meaningful way to establish credit.”

Image Credit: Bloom Credit

This service enables rental apps to report rent payments to the three major credit bureaus to help consumers bolster their credit scores. The goal of this service is to provide individuals with limited credit history the opportunity to establish a more robust credit profile. This move aligns with the broader trend of financial services becoming more accessible and inclusive, as it enables individuals to use their rental payment history as a means to strengthen their creditworthiness.

“In today’s financial landscape, credit history plays a pivotal role in determining an individual’s access to affordable credit,” the company said in the release. “Unfortunately, a significant portion of consumers, especially those who rent their homes, have been left without a meaningful way to establish credit.”

Image Credit: Bloom Credit

Trend Themes

1. Incorporating Rental Payments - Bloom Credit introduces credit reporting service for rental payment data, reflecting the trend of using non-traditional data to assess creditworthiness.

2. Accessible Financial Services - Financial services becoming more inclusive by enabling individuals to use rental payment history to strengthen their creditworthiness.

3. Comprehensive Credit History - The use of rental payment data aims to provide individuals with limited credit history the opportunity to build a more robust credit profile.

Industry Implications

1. Financial Technology - Incorporating rental payments into credit profiles presents disruptive innovation opportunities in the financial technology industry.

2. Real Estate - The reporting of rent payments to credit bureaus creates potential for disruptive innovation in the real estate industry.

3. Consumer Credit Services - Enabling individuals to strengthen their creditworthiness using rental payment data opens up possibilities for disruptive innovation in the consumer credit services industry.

1.8

Score

Popularity

Activity

Freshness