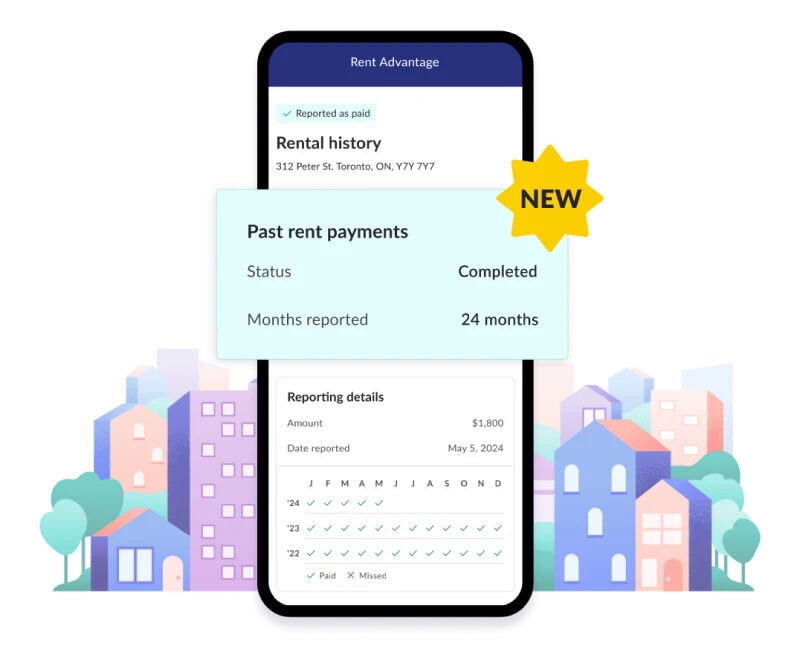

Borrowell is Helping Canadians Build Their Credit with Rent Payments

Borrowell has introduced an innovative program that is a first of its kind in Canada. This new initiative allows renters to report up to 24 months of past rent payments to Equifax Canada, significantly enhancing their ability to build and improve their credit scores.

Rental payments are often one of Canadians' most significant recurring expenses. Borrowell’s program transforms these payments into an opportunity for renters to demonstrate financial responsibility. By integrating rent payment history into their credit profile, participants can unlock better economic opportunities, such as improved loan terms and higher credit limits.

"[...] At Borrowell, we have seen more and more responsible, long-term renters come forward looking for options to build credit. We developed this program to make the credit system fairer for renters and to have their track record of responsible financial behaviour be recognized on their credit profile. This service builds off our Rent Advantage program to allow even more Canadians to achieve their goals faster, like purchasing their first home," said Andrew Graham, CEO and Co-Founder of Borrowell.

Image Credit: Borrowell

Rental payments are often one of Canadians' most significant recurring expenses. Borrowell’s program transforms these payments into an opportunity for renters to demonstrate financial responsibility. By integrating rent payment history into their credit profile, participants can unlock better economic opportunities, such as improved loan terms and higher credit limits.

"[...] At Borrowell, we have seen more and more responsible, long-term renters come forward looking for options to build credit. We developed this program to make the credit system fairer for renters and to have their track record of responsible financial behaviour be recognized on their credit profile. This service builds off our Rent Advantage program to allow even more Canadians to achieve their goals faster, like purchasing their first home," said Andrew Graham, CEO and Co-Founder of Borrowell.

Image Credit: Borrowell

Trend Themes

1. Credit Building Via Rent - Transforming rent payments into credit-building opportunities presents a disruptive shift in how non-traditional financial behaviors are recognized by credit systems.

2. Alternative Financial Data - The integration of alternative financial data, such as rent payments, into credit scores challenges conventional credit assessment methods, offering new avenues for consumers to enhance their financial standing.

3. Rent Payment Digitization - Digitizing rent payments for credit reporting can redefine the landscape of financial inclusivity by leveraging regular expenditures for credit improvement and economic mobility.

Industry Implications

1. Fintech - The fintech industry can capitalize on innovative credit-building tools that utilize alternative data sources, thereby broadening access to financial services.

2. Real Estate - Incorporating rent reporting into credit profiles opens new pathways for the real estate sector to support tenants in achieving better financial prospects, potentially leading to increased homeownership rates.

3. Credit Bureaus - Credit bureaus stand to transform their data collection practices by accepting non-traditional financial information, thereby expanding the scope of creditworthiness assessment.

7.8

Score

Popularity

Activity

Freshness