Expensio.co Simplifies Budgeting, Tracks Expenses, and Saves Money

Ellen Smith — December 5, 2024 — Tech

References: expensio.co

Expensio.co is a personal finance tool designed to simplify money management for users who struggle with tracking expenses, planning budgets, saving, and more.

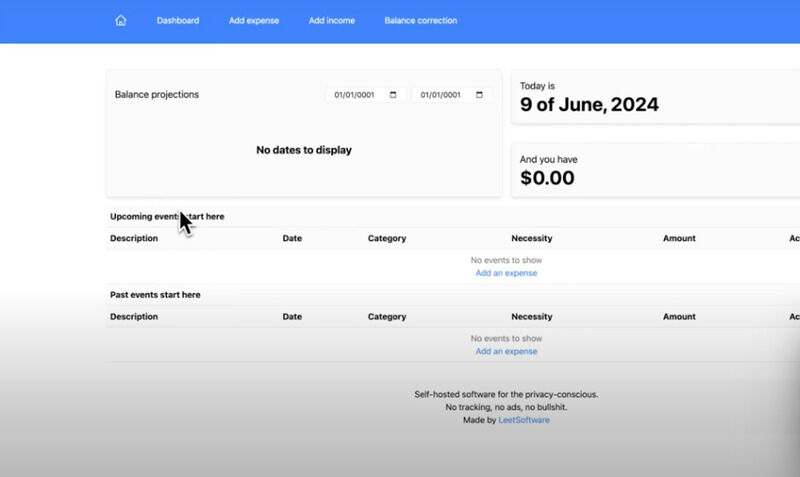

Crafted easily with individuals who find managing finances overwhelming in mind, the platform provides an easy-to-use interface to organize and track finances in a way that is more manageable than usual. Expensio allows users to set and track goals, categorize expenses, and visualize spending habits, all aimed at making financial organization feel less daunting. The tool is particularly useful for those looking to streamline their finances without the need for complex software or processes. Its goal is to help users take control of their financial situation, making it more accessible and easier to navigate.

Image Credit: Expensio.co

Crafted easily with individuals who find managing finances overwhelming in mind, the platform provides an easy-to-use interface to organize and track finances in a way that is more manageable than usual. Expensio allows users to set and track goals, categorize expenses, and visualize spending habits, all aimed at making financial organization feel less daunting. The tool is particularly useful for those looking to streamline their finances without the need for complex software or processes. Its goal is to help users take control of their financial situation, making it more accessible and easier to navigate.

Image Credit: Expensio.co

Trend Themes

1. AI-driven Financial Planning - Integrating AI to predict spending trends can transform how users manage their financial goals.

2. Gamified Expense Tracking - Incorporating gaming elements into expense tracking can increase user engagement and make financial management more enjoyable.

3. Personalized Budgeting Apps - Developing apps that adapt to individual spending habits can offer a more customized and effective budgeting experience.

Industry Implications

1. Fintech - The introduction of user-friendly financial management tools has the potential to disrupt traditional banking services.

2. Mobile App Development - Creating intuitive financial apps can revolutionize how individuals manage their everyday finances.

3. Personal Finance Advisory - Leveraging technology to offer automated budget planning can change the landscape of financial advisory services.

2.5

Score

Popularity

Activity

Freshness