Wingmann Simplifies Budgeting with Automatic Expense Tracking and Insights

Ellen Smith — December 15, 2024 — Tech

References: wingmann.in

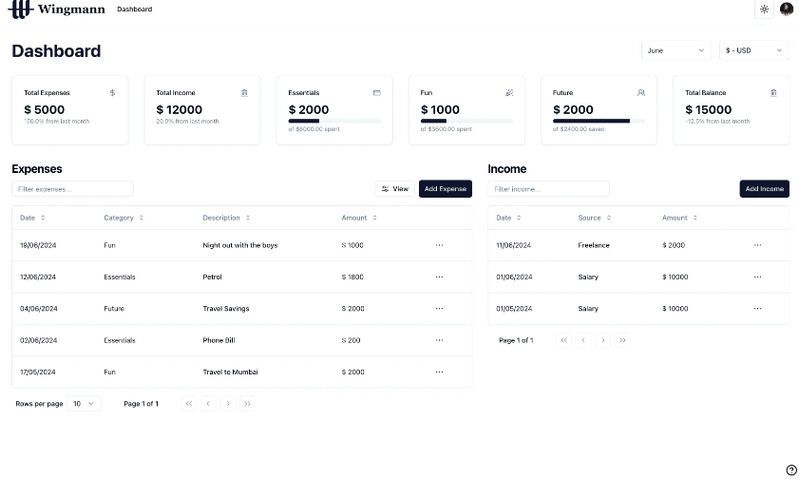

Wingmann is a user-friendly budgeting tool designed to make finance tracking straightforward. It helps users manage their finances by automatically categorizing income and expenses based on the 50/30/20 rule.

With this simple framework, Wingmann makes it easy to allocate 50% of income to necessities, 30% to wants, and 20% to savings or debt. The app allows users to log expenses and income effortlessly, providing a clear overview of their financial situation. Its intuitive interface eliminates the complexity often associated with budgeting apps, offering a hassle-free way to stay on top of personal finances.

Ideal for users who want to simplify their financial tracking without the need for advanced features, Wingmann is a no-frills tool that focuses on delivering essential financial insights.

Image Credit: Wingmann

With this simple framework, Wingmann makes it easy to allocate 50% of income to necessities, 30% to wants, and 20% to savings or debt. The app allows users to log expenses and income effortlessly, providing a clear overview of their financial situation. Its intuitive interface eliminates the complexity often associated with budgeting apps, offering a hassle-free way to stay on top of personal finances.

Ideal for users who want to simplify their financial tracking without the need for advanced features, Wingmann is a no-frills tool that focuses on delivering essential financial insights.

Image Credit: Wingmann

Trend Themes

1. Automated Financial Management - Automated financial tools streamline personal finance by simplifying complex budgeting tasks into easy-to-understand frameworks.

2. Simplified Budgeting Solutions - User-friendly budgeting tools offer straightforward interfaces that cater to individuals seeking clarity in managing their finances.

3. Minimalist Financial Apps - Minimalist finance trackers emphasize essential features, providing users with essential insights without overwhelming them with options.

4. Insight-driven Budgeting - With automatic categorization, finance apps provide users with data-driven insights to guide better financial decision-making.

5. Rule-based Financial Planning - Implementing rules like the 50/30/20 framework, financial tools automate budget allocation to ensure balanced spending and saving.

Industry Implications

1. Personal Finance Software - The personal finance software industry is evolving with user-centric apps that prioritize simplicity and essential functionality.

2. Fintech Development - Fintech startups are exploring ways to reduce financial management complexity, driving innovation in automated tracking systems.

3. Mobile Application Design - Mobile application design is increasingly focused on creating intuitive user experiences, especially in the realm of financial management.

6.4

Score

Popularity

Activity

Freshness