Kedrec Recently Debuted the Cash Flow and Capital App

References: finanznachrichten.de

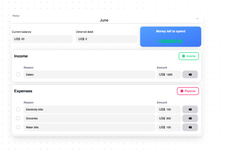

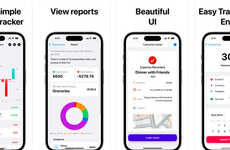

The Cash Flow and Capital app by Kedrec is a recently introduced mobile application designed to help users manage their finances and encourage healthier relationships in this realm.

The Cash Flow and Capital app takes on a rather unconventional approach to personal finance compared to traditional platforms. It prompts the user to manually sort every transaction because "too much automation has created many blind spots." The platform works with the user to simplify spending plans and monthly progress. The equation takes out the total committed expenses planned and the total flexible expenses spent month-to-date from the total income to reveal how much extra cash is available for the month.

In order to connect to the user's financial accounts, Cash Flow and Capital relies on Plaid, an integration that ensures safety and security for the process.

Image Credit: Kedrec

The Cash Flow and Capital app takes on a rather unconventional approach to personal finance compared to traditional platforms. It prompts the user to manually sort every transaction because "too much automation has created many blind spots." The platform works with the user to simplify spending plans and monthly progress. The equation takes out the total committed expenses planned and the total flexible expenses spent month-to-date from the total income to reveal how much extra cash is available for the month.

In order to connect to the user's financial accounts, Cash Flow and Capital relies on Plaid, an integration that ensures safety and security for the process.

Image Credit: Kedrec

Trend Themes

1. Manual Finance Management - Personal finance apps that emphasize manual transaction sorting provide users with greater awareness and control over their financial activities.

2. Automation Alternatives - Platforms that minimize reliance on automation in financial management highlight opportunities for more personalized and aware financial decision-making.

3. Security-centric Integrations - Integrating secure third-party solutions like Plaid in financial applications enhances user trust without compromising convenience.

Industry Implications

1. Fintech Startups - Emerging fintech companies are focusing on innovative personalization tools to offer distinct user experiences in financial management.

2. Financial Advisory Services - Advisory services are leveraging new tools that provide clients with clearer spending plans and enhance financial literacy.

3. Mobile Application Development - The rise of finance-focused apps demonstrates the expanding market for mobile applications that combine security with user-centric design.

8.3

Score

Popularity

Activity

Freshness