Flooz Simplifies Budgeting by Tracking Expenses and Finances

Ellen Smith — November 5, 2024 — Lifestyle

References: flooz.themarelle

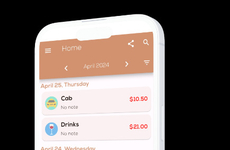

Flooz is a user-friendly finance app designed to streamline personal budget management, made for those who struggle to manage, or wish to maintain their spending. Tailored for individuals seeking simplicity, Flooz allows users to track their monthly expenses with ease.

The app offers intuitive tools to categorize spending, set budget goals, and monitor financial health. By focusing on ease of use, Flooz makes financial planning accessible to users of all experience levels, helping them stay on top of their spending habits. The clear interface provides insights into where money is going, encouraging smarter financial decisions. Whether managing daily expenses or planning for future savings, Flooz simplifies the process, making budgeting less daunting and more effective for everyday users.

Image Credit: Flooz

The app offers intuitive tools to categorize spending, set budget goals, and monitor financial health. By focusing on ease of use, Flooz makes financial planning accessible to users of all experience levels, helping them stay on top of their spending habits. The clear interface provides insights into where money is going, encouraging smarter financial decisions. Whether managing daily expenses or planning for future savings, Flooz simplifies the process, making budgeting less daunting and more effective for everyday users.

Image Credit: Flooz

Trend Themes

1. AI-powered Expense Categorization - Utilizing artificial intelligence to automatically categorize user expenses, transforming the way users interact with their financial data.

2. Gamified Budgeting - Introducing gamification elements into budgeting apps to make financial management more engaging and enjoyable for users.

3. Real-time Financial Insights - Offering real-time analytics and insights into spending patterns, making financial health monitoring instantaneous and accessible.

Industry Implications

1. Fintech - Disrupting traditional banking mechanisms by providing innovative, user-friendly digital finance solutions.

2. Personal Finance Management - Revolutionizing how individuals handle personal budgets through intuitive and accessible technology.

3. Mobile Applications - Transforming the mobile app landscape with advanced finance management tools and user-focused design.

3.7

Score

Popularity

Activity

Freshness