Bread Budgeting Makes Budgeting Fun By Integrating Challenges

Ellen Smith — April 8, 2024 — Lifestyle

References: breadmoney.app

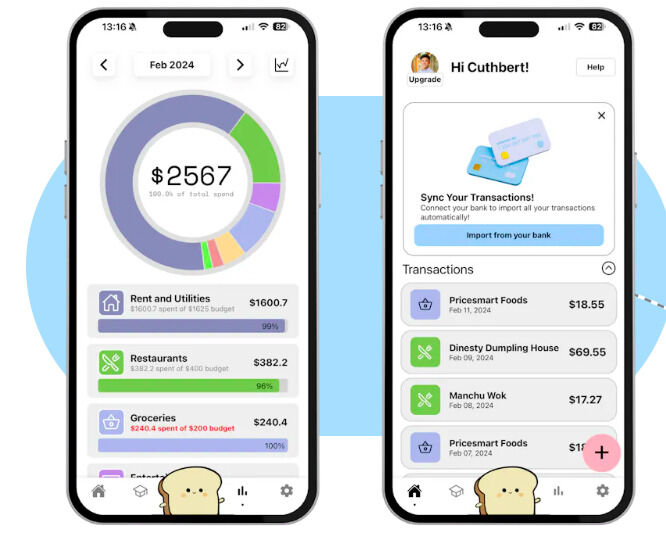

In the realm of budgeting apps, Bread Budgeting stands out with its unique approach — gamifying the saving experience. By transforming financial management into a fun challenge, users are motivated to stay within their monthly budgets to keep Brad the bread alive and unlock adorable bread characters.

The app offers pre-made budget templates for those unsure of where to start, while also providing personalized insights through detailed reports and visualizations. With bank integration, users can effortlessly monitor expenses, categorized neatly and readily accessible at their fingertips.

Bread Budgeting underscores the synergy between budgeting and technology. By leveraging gamification and seamless bank integration, it transforms the traditionally mundane task of budgeting into an engaging and interactive experience. As technology continues to innovate, apps like Bread Budgeting demonstrate how they can revolutionize financial management, making it more accessible, enjoyable, and effective for users.

Image Credit: Bread Budgeting

The app offers pre-made budget templates for those unsure of where to start, while also providing personalized insights through detailed reports and visualizations. With bank integration, users can effortlessly monitor expenses, categorized neatly and readily accessible at their fingertips.

Bread Budgeting underscores the synergy between budgeting and technology. By leveraging gamification and seamless bank integration, it transforms the traditionally mundane task of budgeting into an engaging and interactive experience. As technology continues to innovate, apps like Bread Budgeting demonstrate how they can revolutionize financial management, making it more accessible, enjoyable, and effective for users.

Image Credit: Bread Budgeting

Trend Themes

1. Gamified Budgeting Apps - Transforming financial management into an engaging challenge through gamification.

2. Personalized Financial Insights - Providing customized reports and visualizations for tailored user experiences.

3. Seamless Bank Integration - Effortlessly monitoring expenses with categorized and readily accessible data.

Industry Implications

1. Personal Finance - Opportunity for apps to innovate and make budgeting more enjoyable and interactive.

2. Fintech - Leveraging technology to revolutionize financial management for a more effective user experience.

3. Mobile Applications - Integrating gamification and bank services to enhance the functionality and appeal of budgeting apps.

3.8

Score

Popularity

Activity

Freshness