The Achieve GOOD™ App Aims to Assist Consumers with Debt

References: achieve & prnewswire

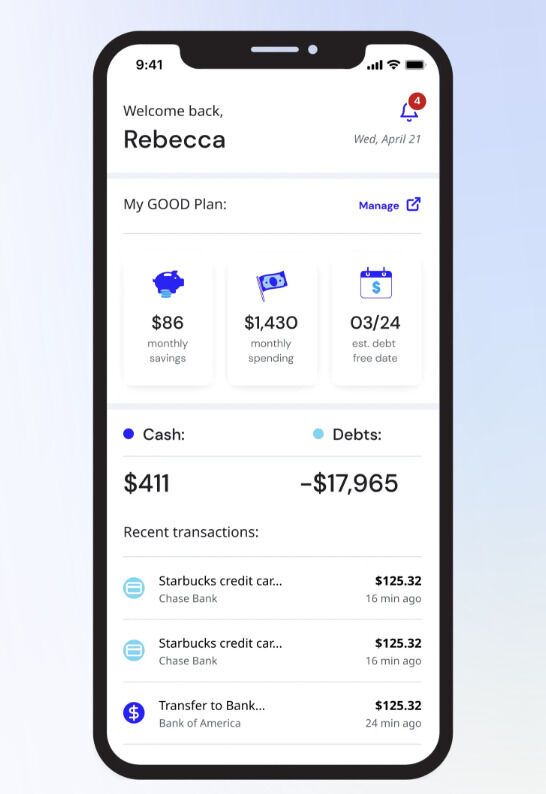

Achieve, a prominent figure in digital personal finance, has introduced Achieve GOOD™, a new mobile app designed to assist Americans in overcoming financial challenges, particularly the rising credit card balances and delinquency rates prevalent in the country. The app offers users a comprehensive "do-it-yourself" debt management tool at no cost, which promises to help with the consolidation of debts with personalized insights and recommendations. It can even help one devise a customized payoff plans.

With features such as real-time spending alerts and projected payoff timelines, Achieve GOOD™ equips users with actionable insights to navigate their financial journey with confidence, tailored recommendations, and long-term financial stability. The Achieve GOOD™ app complements Achieve's existing offering, including the Achieve MoLO (Money Left Over) app

Image Credit: Achieve

With features such as real-time spending alerts and projected payoff timelines, Achieve GOOD™ equips users with actionable insights to navigate their financial journey with confidence, tailored recommendations, and long-term financial stability. The Achieve GOOD™ app complements Achieve's existing offering, including the Achieve MoLO (Money Left Over) app

Image Credit: Achieve

Trend Themes

1. AI-powered Financial Management - AI-driven debt management apps offer customized financial advice and efficiency by understanding user spending behaviors and trends.

2. Real-time Financial Monitoring - Apps providing real-time alerts and spending analysis help consumers stay on top of their finances and prevent credit-related issues.

3. Personalized Debt Consolidation Services - Mobile apps offering tailored debt consolidation plans address individual financial needs, improving the user’s ability to manage and reduce debt.

Industry Implications

1. Fintech - The fintech industry sees an increased demand for mobile apps providing personalized financial management and debt consolidation services.

2. Personal Finance - Innovations in personal finance apps enable users to proactively manage their financial challenges through tailored recommendations and real-time insights.

3. Consumer Credit Solutions - The rise of consumer-focused credit management tools emphasizes the need for accessible and effective debt resolution technologies.

7

Score

Popularity

Activity

Freshness