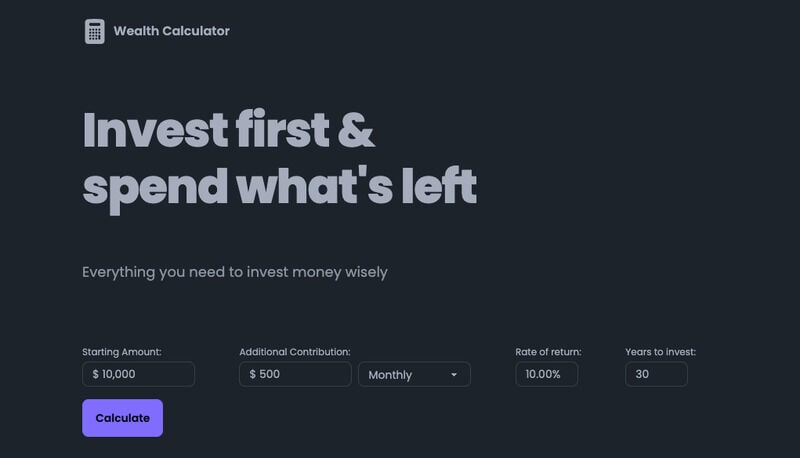

Wealth Calculator Lets You Visualize Your Investment Journey

Ellen Smith — October 28, 2024 — Tech

References: weeealth

Wealth Calculator is a straightforward financial tool designed to help users manage their investments and spending habits.

By allowing individuals to input an initial investment amount along with regular contributions, the calculator provides a visual representation of their financial journey. This enables users to understand how their investments can grow over time and aids in setting realistic financial goals. The tool emphasizes a key principle of personal finance: investing first and then spending what's left. By adopting this approach, users can prioritize their financial growth while ensuring their spending remains within manageable limits.

Wealth Calculator is an essential resource for both novice investors and those looking to refine their investment strategies, ultimately promoting better financial literacy and discipline.

Image Credit: Wealth Calculator

By allowing individuals to input an initial investment amount along with regular contributions, the calculator provides a visual representation of their financial journey. This enables users to understand how their investments can grow over time and aids in setting realistic financial goals. The tool emphasizes a key principle of personal finance: investing first and then spending what's left. By adopting this approach, users can prioritize their financial growth while ensuring their spending remains within manageable limits.

Wealth Calculator is an essential resource for both novice investors and those looking to refine their investment strategies, ultimately promoting better financial literacy and discipline.

Image Credit: Wealth Calculator

Trend Themes

1. Data-driven Financial Planning - Visual tools like Wealth Calculator empower individuals with clear, data-driven financial trajectories for better decision-making.

2. Personalized Investment Strategies - Customizable inputs in financial tools allow users to tailor their investment strategies to individual goals and risk tolerance.

3. Gamification of Financial Management - Interactive and visual elements in financial calculators can turn complex investment planning into an engaging user experience.

Industry Implications

1. Fintech - Innovative financial tools are revolutionizing how people manage investments and plan their financial futures.

2. Wealth Management - Personalized calculators offer wealth management firms new tools to assist clients in visualizing and achieving their financial goals.

3. Educational Technology - Integrating financial literacy tools into educational platforms can enhance learning and promote sound financial habits from an early age.

4.4

Score

Popularity

Activity

Freshness