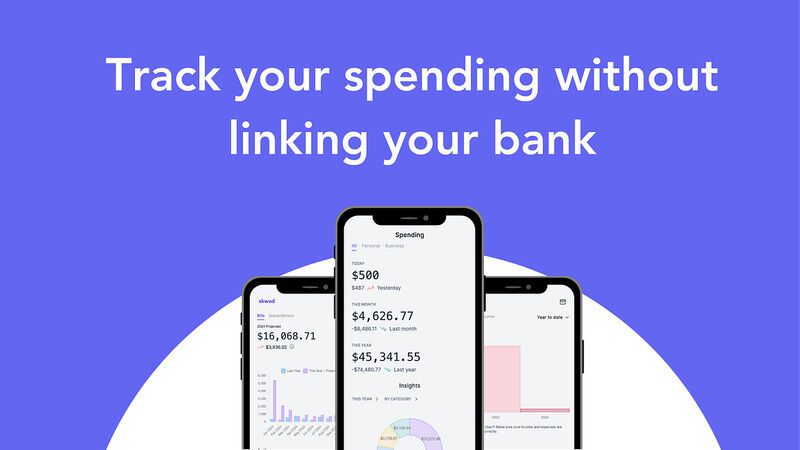

'Skwad' Helps Users Track Spending Without Linking Bank Accounts

Michael Hemsworth — May 24, 2024 — Lifestyle

Most financial tracking apps require users to link their bank and credit card apps, but the 'Skwad' app takes things in a decidedly different direction.

The app works by using built-in email alerts from banks rather than requiring full access to accounts, which will greatly enhance peace of mind for users. Users can also upload data from their account to incorporate older transactions, if desired, in an easy way that still doesn't require account access. Transactions of all kinds that are incorporated into the system are categorized accordingly to help users intuitively manage their funds.

The 'Skwad' app responds to a growing desire amongst consumers for privacy-first products that don't require them to provide access to sensitive data as concerns continue to increase on the topic.

The app works by using built-in email alerts from banks rather than requiring full access to accounts, which will greatly enhance peace of mind for users. Users can also upload data from their account to incorporate older transactions, if desired, in an easy way that still doesn't require account access. Transactions of all kinds that are incorporated into the system are categorized accordingly to help users intuitively manage their funds.

The 'Skwad' app responds to a growing desire amongst consumers for privacy-first products that don't require them to provide access to sensitive data as concerns continue to increase on the topic.

Trend Themes

1. Email-based Financial Notifications - The shift towards utilizing email alerts for financial tracking exemplifies a greater emphasis on user privacy and control.

2. Account-independent Data Integration - Users being able to upload data manually to financial apps without direct account linkage highlights an innovative approach to data security.

3. Privacy-first Consumer Technology - The increasing focus on privacy-first products in finance apps reflects a broader consumer trend towards safeguarding personal information.

Industry Implications

1. Fintech - The fintech industry is seeing a surge in privacy-centric solutions that prioritize user data protection.

2. Consumer Software - Consumer software developers are innovating to meet the rising demand for secure, user-centric applications.

3. Personal Finance - Personal finance tools are evolving to offer more secure, transparent services that do not require full access to sensitive data.

4.3

Score

Popularity

Activity

Freshness