New fintech tools allows employees access their already-earned wages before payday

Trend - Financial technology companies are disrupting traditional payroll systems by offering earned wage access services, allowing employees to access their accrued wages before scheduled payday. This innovation is increasingly being offered as an employee benefit by organizations seeking to provide greater financial flexibility to their workforce.

Insight - Financial stress and rigid payment schedules can create significant challenges for workers who need access to their earned income between pay periods. As the gig economy and financial technology evolve, consumers increasingly expect greater flexibility and immediacy in their financial transactions. This shift is driving demand for services that provide more control over when and how employees can access their earned wages, reflecting a broader cultural movement toward personalized, on-demand financial solutions that better align with modern lifestyles and needs.

Insight - Financial stress and rigid payment schedules can create significant challenges for workers who need access to their earned income between pay periods. As the gig economy and financial technology evolve, consumers increasingly expect greater flexibility and immediacy in their financial transactions. This shift is driving demand for services that provide more control over when and how employees can access their earned wages, reflecting a broader cultural movement toward personalized, on-demand financial solutions that better align with modern lifestyles and needs.

Workshop Question - How might your organization leverage financial technology to provide more flexible payment solutions?

Trend Themes

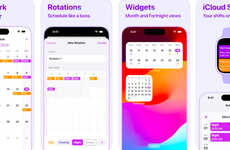

1. On-demand Financial Solutions - The rise of technology-driven financial services is enabling real-time wage access, catering to the consumer demand for greater immediacy and personalization in financial transactions.

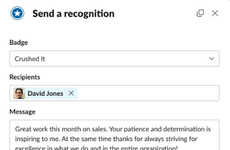

2. Flexible Employee Benefits - Businesses are increasingly incorporating flexible wage access into their employee benefits packages, enhancing worker satisfaction by offering solutions that address financial stress and improve work-life balance.

3. Technology-enhanced Payroll Solutions - Innovative technology is reshaping traditional payroll processes by integrating services that permit employees early access to earned wages, thus improving operational efficiency and employee retention for businesses.

Industry Implications

1. Financial Technology - Fintech companies are revamping traditional finance models by implementing services that align with modern consumer expectations for speed and autonomy in financial management.

2. Human Resources and Payroll - HR and payroll services are rapidly evolving to meet demand for flexible wage access, offering fresh opportunities to enrich employee engagement and streamline administrative procedures.

3. Employee Benefits and Wellness - The employee benefits sector is being transformed as businesses prioritize financial wellness programs that incorporate innovative solutions like earned wage access to boost employee loyalty and reduce turnover.

4 Featured, 31 Examples:

9,015 Total Clicks

Date Range:

Jul 24 — Dec 24

Trending:

This Year and Mild

Consumer Insight Topics: