Tapcheck Provides On-Demand Pay Access for Employee Financial Flexibility

Grace Mahas — December 6, 2024 — Business

References: tapcheck

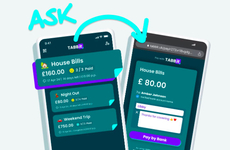

Tapcheck is addressing the growing demand for financial wellness benefits with its earned wage access platform that allows employees to access their earned wages before traditional payday. The solution integrates seamlessly with existing payroll systems and requires zero cost implementation for employers while providing workers with the flexibility to withdraw earned wages through a mobile app. This financial tool aims to reduce employee stress, with 70% of users reporting decreased financial anxiety and 89% expressing increased loyalty to employers offering the benefit.

The platform differentiates itself through its comprehensive approach to financial wellness, combining on-demand pay access with educational resources and a dedicated support system. Its impact on workforce management is significant, with 95% of employers reporting improved pay flexibility for staff and 87% citing better retention rates. The service also helps companies attract talent, as 51% of employers note faster job filling rates, while 67% of employees report avoiding high-interest debt through early wage access.

Image Credit: Tapcheck

The platform differentiates itself through its comprehensive approach to financial wellness, combining on-demand pay access with educational resources and a dedicated support system. Its impact on workforce management is significant, with 95% of employers reporting improved pay flexibility for staff and 87% citing better retention rates. The service also helps companies attract talent, as 51% of employers note faster job filling rates, while 67% of employees report avoiding high-interest debt through early wage access.

Image Credit: Tapcheck

Trend Themes

1. On-demand Pay Access - The integration of on-demand pay options into payroll systems offers significant flexibility, reducing employee financial stress and improving workplace satisfaction.

2. Financial Wellness Tools - The rise of platforms combining earned wage access with educational resources and support systems caters to a holistic approach in enhancing employee financial literacy.

3. Tech-integrated Employee Benefits - Solutions that seamlessly integrate with existing payroll systems and offer cost-free implementation for employers are increasingly in demand for attracting and retaining talent.

Industry Implications

1. Human Resources - HR departments are leveraging advanced financial wellness benefits to improve employee retention and job satisfaction metrics.

2. Fintech - Financial technology companies are innovating with tools that enable employees to access their earnings, thus disrupting traditional payroll processes.

3. Employee Benefits Services - Organizations specializing in employee benefits are incorporating comprehensive financial wellness programs to attract modern workforce talent.

6.1

Score

Popularity

Activity

Freshness