Chime Boasts Activities for Financial Progress Month

Chime's initiative to redefine Financial Literacy Month as Financial Progress Month aims to address the significant gap in financial education highlighted by recent survey findings. The survey reveals a concerning lack of basic financial knowledge among respondents, emphasizing the need for accessible and practical resources to improve financial literacy.

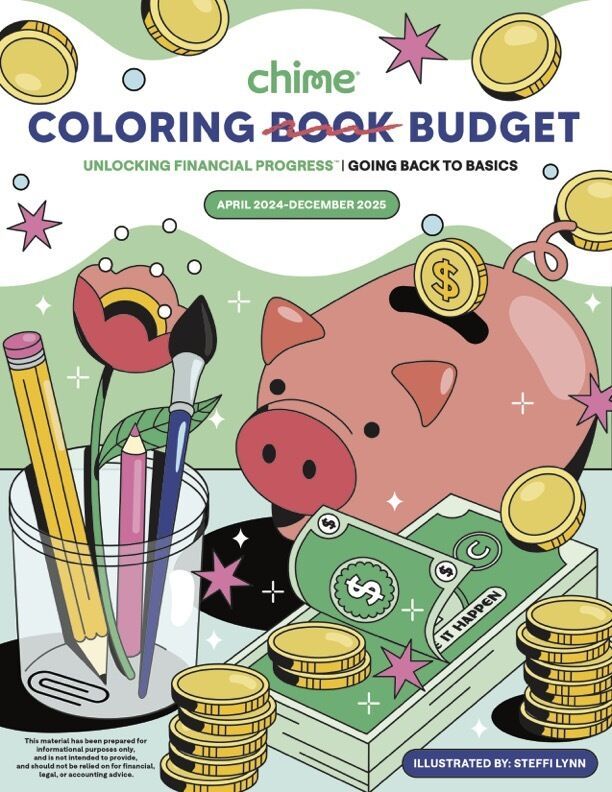

As part of Financial Progress Month, Chime introduces various strategies to make essential financial topics more approachable and engaging. These include innovative approaches such as Coloring Budgets, which leverage the therapeutic benefits of coloring to help users create and visualize their budgets effectively. Additionally, Chime collaborates with T-Pain to deliver a Progress 101 class at Clark Atlanta University, bringing financial literacy education directly into the classroom.

Chime also integrated digital solutions like Zogo, a gamified financial education platform, to offer users interactive learning experiences and practical tools to enhance financial knowledge.

Image Credit: Chime

As part of Financial Progress Month, Chime introduces various strategies to make essential financial topics more approachable and engaging. These include innovative approaches such as Coloring Budgets, which leverage the therapeutic benefits of coloring to help users create and visualize their budgets effectively. Additionally, Chime collaborates with T-Pain to deliver a Progress 101 class at Clark Atlanta University, bringing financial literacy education directly into the classroom.

Chime also integrated digital solutions like Zogo, a gamified financial education platform, to offer users interactive learning experiences and practical tools to enhance financial knowledge.

Image Credit: Chime

Trend Themes

1. Therapeutic Financial Tools - Innovative approaches such as Coloring Budgets leverage the therapeutic benefits of coloring for effective budget visualization.

2. Interactive Financial Education - Chime integrates digital solutions like Zogo, a gamified financial education platform, to offer interactive learning experiences for users.

3. Personalized Financial Learning - Through collaborations like the Progress 101 class at Clark Atlanta University with T-Pain, Chime brings personalized financial literacy education directly into the classroom.

Industry Implications

1. Financial Technology - With the integration of gamified platforms like Zogo, there are opportunities for disruption and innovation in financial education technology.

2. Education - Collaborations in financial literacy education, like Chime's partnership with universities, indicate a growing intersection between finance and traditional education.

3. Health and Wellness - The use of therapeutic benefits in financial activities, such as Coloring Budgets, presents opportunities to merge financial literacy with mental well-being in the wellness sector.

6.8

Score

Popularity

Activity

Freshness