WalletPop Clever Money Management Tips

Pearl — July 25, 2008 — Life-Stages

Times are hard, and getting harder with the rising cost of food, gas and other basic necessities. Getting through a recession when money is tight requires good money management. Walletpop is a great site to help people do just that. The website covers a whole slew of information and offers great tools.

There are several calculators for just about anything financial that needs calculating, from budgeting to paychecks, to savings and college planning.

Their Economizer page for example has four main sections to check out - Cut Costs, Get Deals, Make More, Beat Debt. Each offers its own blog with informative articles and an expert to ask questions. All is not doom and gloom. There are also sections on investing, small business and several blogs entitled Daily Deal, Fantastic Freebies and even Sex Sells.

There are several calculators for just about anything financial that needs calculating, from budgeting to paychecks, to savings and college planning.

Their Economizer page for example has four main sections to check out - Cut Costs, Get Deals, Make More, Beat Debt. Each offers its own blog with informative articles and an expert to ask questions. All is not doom and gloom. There are also sections on investing, small business and several blogs entitled Daily Deal, Fantastic Freebies and even Sex Sells.

Trend Themes

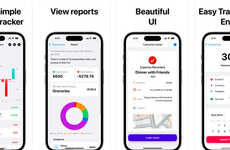

1. Smart-saving - With the current recession, people are looking for ways to cut back on spending and manage money effectively, creating an opportunity for innovations in smart-saving tools and apps.

2. Financial Education - As people struggle to navigate financial challenges, there is a growing need for accessible financial education, leading to opportunities for disruptive innovation in this space.

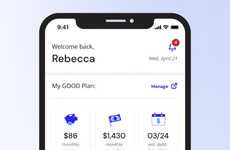

3. Digital Financial Planning - With the rise of digital financial planning tools that offer personalized advice, there is great potential for innovation in this area to help people better manage their finances.

Industry Implications

1. Personal Finance - The personal finance industry can benefit from offering innovative new products and services that help people save money and manage their finances effectively during tough times.

2. Fintech - Fintech companies can capitalize on the growing need for digital financial planning tools that offer personalized advice and help people navigate financial challenges.

3. Education - With the need for accessible financial education on the rise, innovative education companies can step up to meet this demand and create more effective tools and resources.

1.6

Score

Popularity

Activity

Freshness