Kotani Pay is Using Stablecoins for Payments to African Refugees

References: kotanipay & news.bitcoin

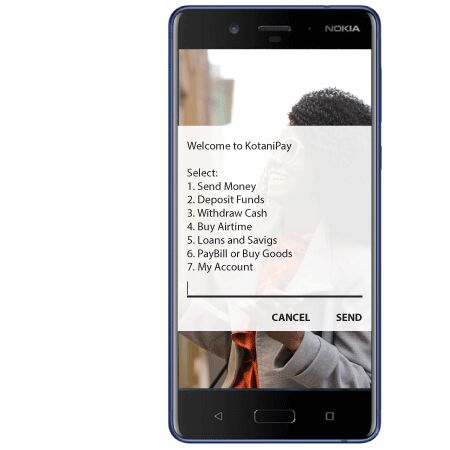

Countries have had many problems in distributing universal basic income payments to individuals in need, especially if those individuals are of an under-represented group—like refugees, for example. Kenyan fintech company Kotani Pay is trying to resolve such issues in distribution by using Stablecoins to transfer funds to African refugees. This project is supported by the Refugee Integration Organisation (RIO) and Impact Market. Through this collaboration, Kotani Pay ensures that non-smartphone holders will also benefit from the service—described as "a pioneering achievement in the world of universal basic income payments, digital currencies, and the inclusivity of refugees" by the company.

The collaborators are relying on the Celo blockchain to make this exchange and support to African refugee communities possible, while also keeping fraud and corruption at bay.

Image Credit: Kotani Pay

The collaborators are relying on the Celo blockchain to make this exchange and support to African refugee communities possible, while also keeping fraud and corruption at bay.

Image Credit: Kotani Pay

Trend Themes

1. Stablecoin Payments for Refugees - Using Stablecoins to transfer funds to refugees provides a reliable and secure way to distribute universal basic income payments.

2. Blockchain-powered Distribution - Leveraging blockchain technology for universal basic income payments can increase efficiency, accessibility, and transparency.

3. Inclusive Financial Services for Under-represented Groups - Providing financial services to non-smartphone holders and other marginalized communities is an opportunity for disruptive innovation in the fintech industry.

Industry Implications

1. Fintech - Fintech companies can leverage stablecoin payments and blockchain technology to improve the distribution of universal basic income payments.

2. Blockchain - Blockchain technology can enable secure and transparent distribution of funds, making it a key player in the universal basic income payment space.

3. Social Impact - Organizations focused on social impact can utilize fintech solutions and blockchain technology for more inclusive and equitable distribution of resources.

2.6

Score

Popularity

Activity

Freshness