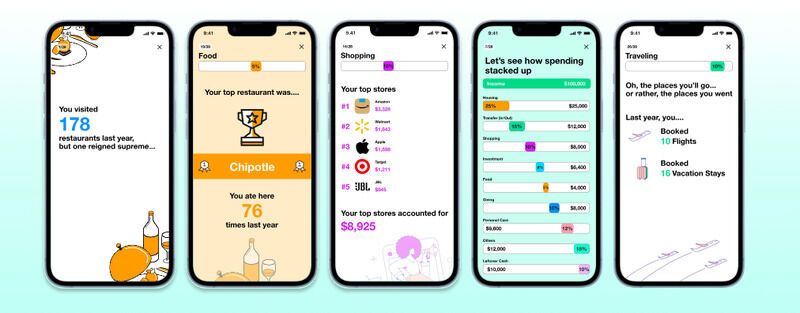

Parcely Finance is Like 'Spotify Wrapped' for Spending Habits

Ellen Smith — June 18, 2024 — Lifestyle

References: parcelyfinance

Parcely Finance revolutionizes personal finance management by transforming spending habits into engaging narratives, akin to Spotify Wrapped but for your money.

Unlike traditional finance apps that overwhelm users with data tables, Parcely takes a refreshing approach by presenting spending insights in a visually appealing and clickable story format. By simplifying financial reporting, Parcely empowers users to gain a deeper understanding of their spending patterns, ultimately enabling them to make more informed financial decisions. Through intuitive storytelling, users can effortlessly navigate their financial journey and identify areas for improvement. With Parcely, managing finances becomes not just a task but a captivating experience, fostering financial literacy and promoting healthier spending habits. Parcely Finance paves the way for a new era of personal finance management, where simplicity and clarity reign supreme.

Image Credit: Parcely Finance

Unlike traditional finance apps that overwhelm users with data tables, Parcely takes a refreshing approach by presenting spending insights in a visually appealing and clickable story format. By simplifying financial reporting, Parcely empowers users to gain a deeper understanding of their spending patterns, ultimately enabling them to make more informed financial decisions. Through intuitive storytelling, users can effortlessly navigate their financial journey and identify areas for improvement. With Parcely, managing finances becomes not just a task but a captivating experience, fostering financial literacy and promoting healthier spending habits. Parcely Finance paves the way for a new era of personal finance management, where simplicity and clarity reign supreme.

Image Credit: Parcely Finance

Trend Themes

1. Storytelling Finance - Harnessing narrative techniques turns financial data into compelling stories, enhancing user engagement and comprehension.

2. Visual Spending Tools - Interactive and visually appealing formats simplify complex financial information, making it more user-friendly and accessible.

3. Gamified Financial Literacy - Transforming financial education into an engaging experience increases user interaction and promotes healthier spending habits.

Industry Implications

1. Personal Finance Apps - Innovative design approaches in personal finance apps can make financial management a more appealing and interactive activity.

2. Financial Education - Engaging educational frameworks provide opportunities for improved financial literacy through captivating and intuitive methods.

3. Data Visualization - Sophisticated data visualization tools can translate complex financial data into easy-to-understand formats for everyday users.

5.3

Score

Popularity

Activity

Freshness