Grapple Invested into its Financier Platforms with AI Tools

Colin Smith — May 6, 2024 — Tech

References: grapple.au & cfotech.au

Grapple, an Australian SME financing company, has enhanced its Lendtech platform by integrating artificial intelligence (AI). This development coincides with the company’s achievement of funding over AUD $200 million in invoices. The Lendtech platform, which is developed in Australia, reported a 115% growth in invoice finance facilities in the new fiscal year. This growth is attributed to the platform’s primary service, Grapple Plus.

The AI feature, named ‘GrappleAI,’ makes Grapple the first invoice financing company to include a ‘ChatAI Assistant’ in its platform. GrappleAI aims to improve efficiency by providing immediate access to information and functions such as disapprovals, risk alerts, monitoring, verifications, and drawdown requests. It also responds to initial questions about general business lending and specific invoice financing rules, which can be tailored for banks or lenders using Grapple’s platform. The addition of GrappleAI is intended to streamline operations, mitigate risk, and offer insights for assessing portfolios, products, or individual clients.

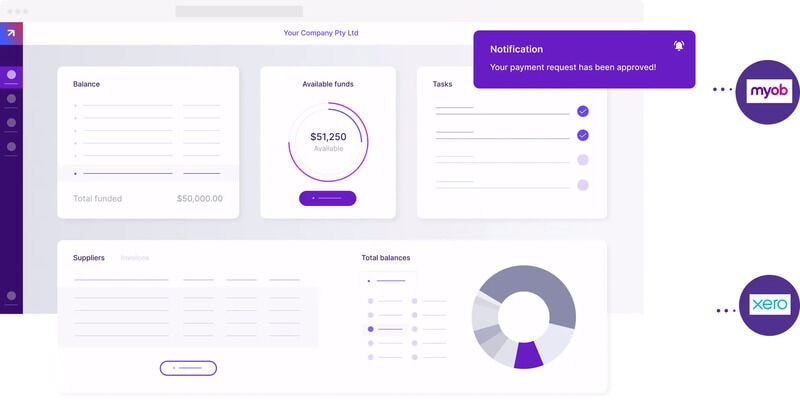

Image Credit: Grapple

The AI feature, named ‘GrappleAI,’ makes Grapple the first invoice financing company to include a ‘ChatAI Assistant’ in its platform. GrappleAI aims to improve efficiency by providing immediate access to information and functions such as disapprovals, risk alerts, monitoring, verifications, and drawdown requests. It also responds to initial questions about general business lending and specific invoice financing rules, which can be tailored for banks or lenders using Grapple’s platform. The addition of GrappleAI is intended to streamline operations, mitigate risk, and offer insights for assessing portfolios, products, or individual clients.

Image Credit: Grapple

Trend Themes

1. AI Integration in Lendtech - The introduction of 'GrappleAI' showcases a new era of efficiency and risk management in the Lendtech industry.

2. Invoice Financing Growth - The 115% increase in invoice finance facilities signals a promising opportunity for financial institutions to explore this expanding market segment.

3. Chatai Assistant in Finance - The utilization of a 'ChatAI Assistant' sets a precedent for personalized customer interactions and streamlined financial processes.

Industry Implications

1. Fintech - The Fintech sector can leverage AI integration to enhance lending platforms and offer innovative solutions for SME financing.

2. Banking - The Banking industry has an opportunity to capitalize on the growing demand for invoice financing solutions to cater to small and medium enterprises.

3. Artificial Intelligence - The Artificial Intelligence industry can explore the use of ChatAI Assistants in financial services to revolutionize customer interactions and operational efficiency.

2.5

Score

Popularity

Activity

Freshness