Kauri Finance 3.0 Represents an Evolution in Online Banking

References: accesswire

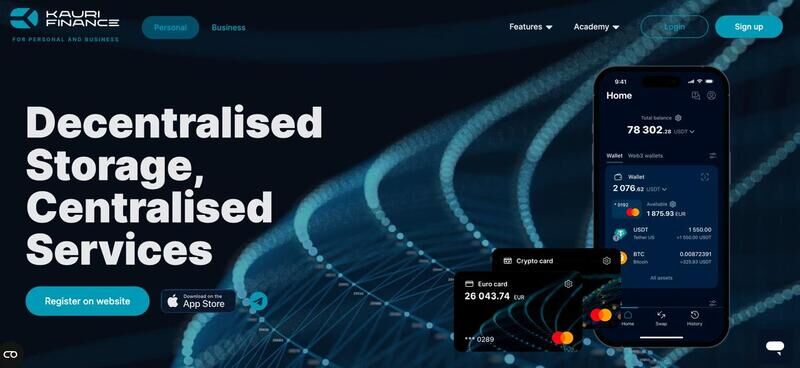

Kauri Finance 3.0's approach to online banking stands out in the market as the brand integrates advanced blockchain features aimed at enhancing financial management for both individual users and businesses. This latest version introduces several cutting-edge functionalities designed to streamline transactions and improve user experience across various platforms.

One of the standout features of Kauri Finance 3.0's online banking experience is its Crypto Card Integration, which will allow seamless management and use of cryptocurrencies via a crypto card compatible with Apple Pay and Google Pay. This feature offers users flexibility in everyday purchases, bridging the gap between traditional financial transactions and digital currencies.

The user-friendly interface of Kauri Finance 3.0's online banking platform enhances accessibility while providing on-the-go banking solutions tailored to modern consumer needs.

Image Credit: Kauri Finance 3.0

One of the standout features of Kauri Finance 3.0's online banking experience is its Crypto Card Integration, which will allow seamless management and use of cryptocurrencies via a crypto card compatible with Apple Pay and Google Pay. This feature offers users flexibility in everyday purchases, bridging the gap between traditional financial transactions and digital currencies.

The user-friendly interface of Kauri Finance 3.0's online banking platform enhances accessibility while providing on-the-go banking solutions tailored to modern consumer needs.

Image Credit: Kauri Finance 3.0

Trend Themes

1. Blockchain-empowered Financial Portfolios - The integration of advanced blockchain features into financial portfolios enhances security and provides real-time transparency of financial assets.

2. Crypto Card Utilization - The seamless management of cryptocurrencies via crypto cards bridges the gap between traditional and digital financial ecosystems, offering new spending flexibility.

3. User-friendly Online Banking Interfaces - Enhanced accessibility of banking platforms through user-friendly interfaces meets the demand for efficient, on-the-go financial management.

Industry Implications

1. Fintech - Merging blockchain technology with financial management redefines the landscape of digital banking services.

2. Cryptocurrency - The development of crypto cards compatible with mainstream payment systems accelerates the mainstream adoption of digital currencies.

3. Mobile Payments - Innovative banking solutions that incorporate mobile payment options address the evolving needs of modern consumers for convenience and accessibility.

7.3

Score

Popularity

Activity

Freshness