Krebit Streamlines the Financial Process for Credit Card Applicants

Ellen Smith — June 12, 2024 — Business

References: krebit.se

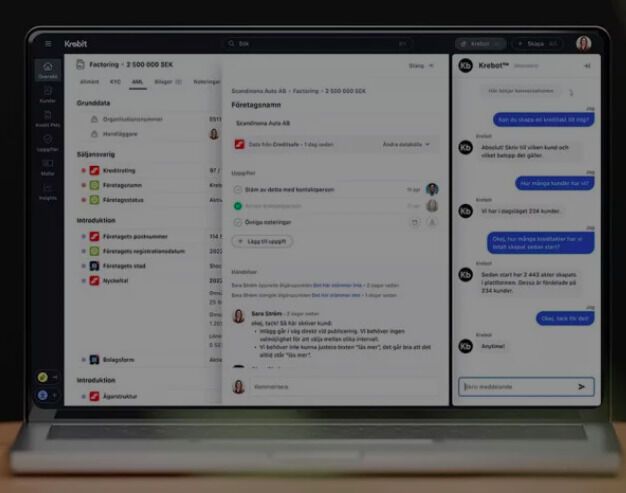

Krebit emerges as a pioneering force in the Swedish market, heralding a new era in B2B credit decision-making across the Nordic region.

By harnessing cutting-edge technology, Krebit streamlines the traditionally cumbersome credit process, making it more efficient and effective than ever before. Through seamless automation, the platform swiftly gathers essential data using company organization numbers, enabling expedited and secure decision-making. With its commitment to a fully digital process, Krebit sets a new standard for speed, accuracy, and convenience in B2B credit assessments. By revolutionizing the credit landscape, Krebit empowers businesses to make informed decisions swiftly, facilitating smoother transactions and fostering growth in the Nordic markets. With Krebit, the future of B2B credit is not just efficient — it's transformative.

Image Credit: Krebit

By harnessing cutting-edge technology, Krebit streamlines the traditionally cumbersome credit process, making it more efficient and effective than ever before. Through seamless automation, the platform swiftly gathers essential data using company organization numbers, enabling expedited and secure decision-making. With its commitment to a fully digital process, Krebit sets a new standard for speed, accuracy, and convenience in B2B credit assessments. By revolutionizing the credit landscape, Krebit empowers businesses to make informed decisions swiftly, facilitating smoother transactions and fostering growth in the Nordic markets. With Krebit, the future of B2B credit is not just efficient — it's transformative.

Image Credit: Krebit

Trend Themes

1. Automated Credit Assessment - Streamlining the credit assessment process through automation reduces time and increases accuracy in financial evaluations.

2. Digital Transformation in Finance - Embracing fully digital processes in B2B credit decision-making enhances speed and security, setting new industry standards.

3. Real-time Data Utilization - Leveraging real-time data collection using company organization numbers optimizes the decision-making process in financial transactions.

Industry Implications

1. Financial Technology - The intersection of finance and technology, driving innovation in credit decision tools and automated processes.

2. Business Services - Providing businesses with enhanced tools for smoother and more informed credit-related transactions.

3. Software Development - Creating and implementing software solutions that facilitate efficient automation and real-time data collection in the financial sector.

2.5

Score

Popularity

Activity

Freshness