Lakefront Finance Targets Gen Alpha, Gen Z & Millennials

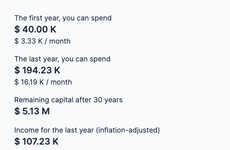

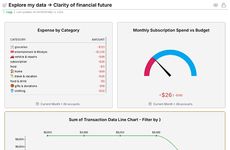

Lakefront Finance is an innovative startup aimed at improving financial literacy among younger generations, specifically targeting Gen Alpha, Gen Z, and Millennials. Founded by two Stanford graduates, the platform is designed to help users navigate personal finance by offering a comprehensive dashboard that combines budgeting and forecasting analytics.

Lakefront Finance identifies a gap in the financial services market, noting that most offerings cater primarily to wealthier, older clients. The brand seeks to fill this niche by assisting young individuals with limited financial resources. The founders emphasize the importance of financial preparedness, drawing from their own experiences as recent graduates entering the workforce.

Central to the platform is its ability to connect with various financial accounts, providing users with a holistic view of their financial status. This feature enables personalized budgeting recommendations and helps users manage expenses more effectively while encouraging them to set realistic long-term goals.

Image Credit: Lakefront Finance

Lakefront Finance identifies a gap in the financial services market, noting that most offerings cater primarily to wealthier, older clients. The brand seeks to fill this niche by assisting young individuals with limited financial resources. The founders emphasize the importance of financial preparedness, drawing from their own experiences as recent graduates entering the workforce.

Central to the platform is its ability to connect with various financial accounts, providing users with a holistic view of their financial status. This feature enables personalized budgeting recommendations and helps users manage expenses more effectively while encouraging them to set realistic long-term goals.

Image Credit: Lakefront Finance

Trend Themes

1. Personalized Budgeting Tools - Innovative platforms are leveraging data connectivity to offer customized budgeting advice tailored to individual financial situations.

2. Gen Alpha and Z Financial Education - Targeting younger demographics with specialized financial literacy programs addresses a critical gap overlooked by traditional financial services.

3. Youth-oriented Financial Dashboards - Interactive dashboards designed for younger users provide a comprehensive overview of personal finance, integrating real-time data from multiple accounts.

Industry Implications

1. Fintech - The Fintech industry is continually evolving to offer more intuitive and accessible financial management tools to younger generations.

2. Edtech - Educational technology platforms are increasingly focusing on financial literacy to prepare young people for financial independence.

3. Personal Finance - Personal finance services are expanding to include more age-specific functionality to cater to the unique needs of Gen Alpha, Gen Z, and Millennials.

5.6

Score

Popularity

Activity

Freshness