Finabled Retirement Calculator Helps People Manage Their Finances

Ellen Smith — April 22, 2024 — Life-Stages

References: finabled

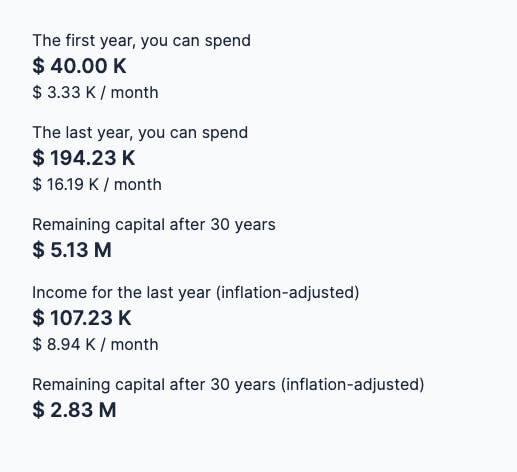

Introducing the Finabled Retirement Calculator, a modern and simple tool designed to help individuals plan for their retirement or Financial Independence, Retire Early goals. Saving for retirement isn't always top of mind for many, but with the Finabled Retirement Calculator, creating a financial plan becomes more accessible and straightforward.

This innovative calculator takes the guesswork out of retirement planning by showing how a capital lump sum translates into a yearly cash flow. For example, users can input their desired withdrawal rate, such as the 4% rule, and see how it impacts their retirement income over time.

The Finabled Retirement Calculator empowers individuals to visualize their financial future, making it easier to set goals and track progress towards retirement readiness. With this tool, users can make informed decisions about their savings, investments, and retirement lifestyle.

Image Credit: Finabled Retirement Calculator

This innovative calculator takes the guesswork out of retirement planning by showing how a capital lump sum translates into a yearly cash flow. For example, users can input their desired withdrawal rate, such as the 4% rule, and see how it impacts their retirement income over time.

The Finabled Retirement Calculator empowers individuals to visualize their financial future, making it easier to set goals and track progress towards retirement readiness. With this tool, users can make informed decisions about their savings, investments, and retirement lifestyle.

Image Credit: Finabled Retirement Calculator

Trend Themes

1. Simplified Retirement Planning - Innovative calculators like Finabled make retirement planning more straightforward and accessible for individuals.

2. Visualization of Financial Future - Tools such as the Finabled Retirement Calculator empower users to visualize and plan for their financial future effectively.

3. Personalized Income Projections - Calculators that provide personalized income projections, such as the Finabled tool, enhance users' retirement planning experience.

Industry Implications

1. Financial Technology (fintech) - Fintech companies can leverage innovative retirement calculators to offer more user-friendly and effective financial planning solutions.

2. Personal Finance Management - The personal finance management industry can benefit from integrating tools like the Finabled Retirement Calculator to improve users' financial planning experiences.

3. Retirement Planning Services - Providers of retirement planning services could enhance their offerings by incorporating advanced calculators that offer personalized income projections like Finabled.

5.3

Score

Popularity

Activity

Freshness