EveryDollar Aids Users in Understanding Their Monthly Finances

References: everydollar

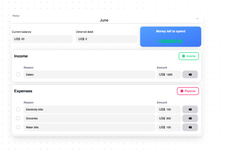

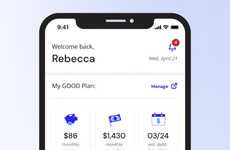

EveryDollar is an online platform developed to help users create a well-balanced budgeting system in order to grasp their respective financial goals. It works with a simple set-up process, beginning by adding their monthly income, followed by incorporating the expected expenses that are enabled monthly. The expenses can be personalized to each respective user -- this can include groceries, fitness expenses, gas, mobile plans, and more.

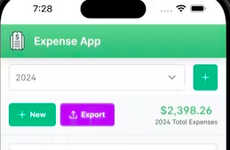

Most importantly, EveryDollar manages one's spending habit, tracking each transaction to ensure that it correlates within the selected budgeting plan. The platform can be used across multiple mediums, as it syncs each user's information through their secure accounts. The EveryDollar app is available on desktop and mobile devices through the App Store and Google Play.

Most importantly, EveryDollar manages one's spending habit, tracking each transaction to ensure that it correlates within the selected budgeting plan. The platform can be used across multiple mediums, as it syncs each user's information through their secure accounts. The EveryDollar app is available on desktop and mobile devices through the App Store and Google Play.

Trend Themes

1. Personalized Budgeting - Disruptive innovation opportunity: Develop a budgeting app that automatically categorizes expenses based on user spending patterns and offers personalized financial advice.

2. Real-time Expense Tracking - Disruptive innovation opportunity: Create an expense tracking app that uses AI technology to capture and analyze receipts, providing users with real-time insights into their spending habits.

3. Multi-platform Budgeting - Disruptive innovation opportunity: Build a budgeting platform that seamlessly syncs financial data across multiple devices and operating systems, allowing users to access and manage their budgets on any device.

Industry Implications

1. Financial Technology (fintech) - Disruptive innovation opportunity: Develop advanced budgeting tools and applications that leverage technology to streamline financial management for individuals and businesses.

2. Mobile App Development - Disruptive innovation opportunity: Create mobile budgeting apps with enhanced features like intuitive interfaces, automated budget calculations, and personalized financial insights.

3. Data Analytics - Disruptive innovation opportunity: Utilize data analytics and machine learning algorithms to analyze spending patterns and provide actionable insights for better financial decision-making.

2.4

Score

Popularity

Activity

Freshness