The Apple Card Savings Account Offers Instant Access to Yields

Michael Hemsworth — April 18, 2023 — Tech

References: apple & techcrunch

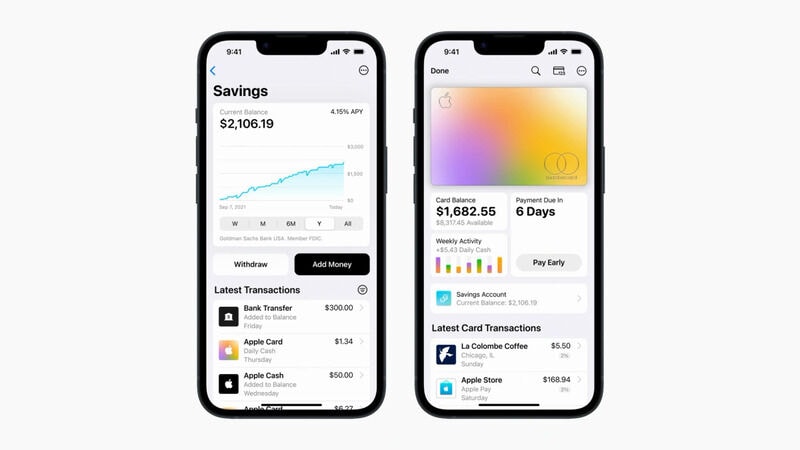

The Apple Card savings account is being touted as a high-interest option for consumers to use as a way to make the most of the funds, while also benefiting from their yields being immediately available. The account, which is managed by Goldman Sachs, provides consumers the option to add funds to their savings account where they can enjoy competitive interest rates. The savings account is available from within the user's iPhone Wallet app where the balance is displayed along with recent transactions and the option to deposit or withdraw funds.

Vice President of Apple Pay and Apple Wallet Jennifer Bailey spoke on the Apple Card savings account saying, "Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.”

Image Credit: Apple

Vice President of Apple Pay and Apple Wallet Jennifer Bailey spoke on the Apple Card savings account saying, "Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.”

Image Credit: Apple

Trend Themes

1. High-interest Savings Accounts - The trend of offering high-interest savings accounts such as the new Apple Card account is disrupting traditional banking models and creating opportunities for digital integration.

2. Mobile Banking Apps - The increasing use of mobile banking apps, such as the Apple Wallet app, is disrupting traditional banking models, offering customers more convenience and accessibility in managing their finances.

3. Personal Finance Management - The trend towards personal finance management tools like the Apple Card savings account is empowering consumers to better manage their money and create more efficient budgets.

Industry Implications

1. Banking - As high-interest savings accounts are proving popular with tech firms such as Apple, traditional banking institutions may be forced to adapt and innovate with new tools and features to remain competitive.

2. Technology - The emergence of mobile banking apps such as the Apple Wallet app and the use of AI and machine learning to improve personal finance management tools is creating opportunities for tech companies to disrupt the finance industry and create more personalized financial experiences for consumers.

3. Finance - The increasing popularity of personal finance management tools and high-interest savings accounts among consumers is demonstrating a demand for more personalized and efficient financial products, offering opportunities for financial institutions to innovate and better meet customer needs.

1.3

Score

Popularity

Activity

Freshness