The PayPal "Super App" Arrives Following Partnership With Synchrony Bank

Niko Pajkovic — September 22, 2021 — Business

References: paypal & techcrunch

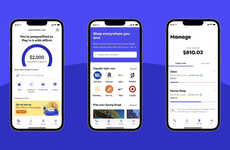

Paypal has officially launched a new version of its popular digital wallet and payments platform, which has been loosely dubbed the PayPal "super app."

A major update, the new app will combine a variety of financial tools offered by the company into one slick, user-friendly platform. These features include direct deposit, bill pay, peer-to-peer payments, digital wallet functionalities, shopping tools, crypto conversions, and more.

As part of the new launch, PayPal has also teamed up with Synchrony Bank to release high-yield savings account aptly titled 'PayPal Savings.' These new updates represent an incredibly exciting development for the company as they allow PayPal to shift from a payments-only utility tool to a full-fledged finance app. In addition, the new updates also include a variety of future-forward features aimed at neobank users and cryptocurrency holders.

Image Credit: Shutterstock

A major update, the new app will combine a variety of financial tools offered by the company into one slick, user-friendly platform. These features include direct deposit, bill pay, peer-to-peer payments, digital wallet functionalities, shopping tools, crypto conversions, and more.

As part of the new launch, PayPal has also teamed up with Synchrony Bank to release high-yield savings account aptly titled 'PayPal Savings.' These new updates represent an incredibly exciting development for the company as they allow PayPal to shift from a payments-only utility tool to a full-fledged finance app. In addition, the new updates also include a variety of future-forward features aimed at neobank users and cryptocurrency holders.

Image Credit: Shutterstock

Trend Themes

1. All-in-one Finance Apps - The launch of PayPal's 'super app' represents an opportunity for other fintechs to combine various financial tools into one platform, improving user experience and convenience.

2. High-yield Savings Accounts - PayPal's partnership with Synchrony Bank to offer high-yield savings accounts presents a disruptive innovation opportunity for traditional banks and credit unions to re-evaluate their own savings offerings.

3. Future-forward Financial Tools - By including features such as cryptocurrency conversions and neobank functionalities, PayPal's 'super app' is setting a trend for the integration of innovative financial tools in mainstream financial services.

Industry Implications

1. Fintech - The rise of all-in-one finance apps and high-yield savings accounts presents both an opportunity and a challenge for fintech startups to differentiate themselves and provide unique value propositions.

2. Traditional Banking - PayPal's move into the finance app space represents a threat to traditional banks and credit unions, who must adapt to provide similar convenience and functionality to customers.

3. Cryptocurrency - PayPal's inclusion of cryptocurrency conversions in their 'super app' demonstrates the increasing mainstream adoption of crypto and presents opportunities for other crypto-related financial services to emerge.

3.7

Score

Popularity

Activity

Freshness