Ally Launches Innovative Savings Account Tools

Glenn Mandel — February 12, 2020 — Tech

References: ally & bankinnovation.net

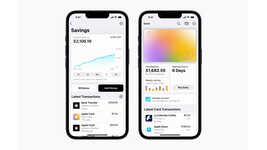

Ally Bank, the largest fully digital bank in the U.S, has announced powerful new capabilities to its online savings account that will change the way people think about—and behave toward—saving. The Bank has launched new smart savings tools to address the pain points of saving to make it easier, faster and more gratifying than ever.

For example, with Ally's new "Buckets, customers can organize funds and visualize different savings goals, all in one account. Like “digital envelopes,” customers can customize buckets to reflect what matters most to them, from “Visiting Mom for the Holidays” to “Engagement Ring.” Buckets also give users a clear picture of exactly where they stand with each priority.

Another new tool is "Boosters," which automate saving through regular, ongoing contributions that add up over time. Notably, Boosters work with customers’ existing checking accounts, whether they bank with Ally or another institution.

By making savings easy and intuitive, Ally is bring a new perspective to banking

For example, with Ally's new "Buckets, customers can organize funds and visualize different savings goals, all in one account. Like “digital envelopes,” customers can customize buckets to reflect what matters most to them, from “Visiting Mom for the Holidays” to “Engagement Ring.” Buckets also give users a clear picture of exactly where they stand with each priority.

Another new tool is "Boosters," which automate saving through regular, ongoing contributions that add up over time. Notably, Boosters work with customers’ existing checking accounts, whether they bank with Ally or another institution.

By making savings easy and intuitive, Ally is bring a new perspective to banking

Trend Themes

1. Smart Savings Tools - The introduction of smart savings tools like 'Buckets' and 'Boosters' opens up opportunities for disruptive innovations in personal finance management.

2. Digital Envelopes - The concept of 'digital envelopes' introduced by Ally Bank's 'Buckets' feature presents opportunities for new applications in budgeting and goal-oriented saving.

3. Automated Saving - The 'Boosters' tool's ability to automate regular saving offers potential for disruptive innovations in helping individuals develop healthy saving habits.

Industry Implications

1. Personal Finance - The innovative savings account tools from Ally Bank have the potential to disrupt the personal finance industry by empowering individuals to better manage their finances and reach their savings goals.

2. Digital Banking - Ally Bank's new capabilities for online savings accounts introduce disruptive innovation opportunities for the digital banking industry, revolutionizing the way people save and interact with their money.

3. Financial Technology - The introduction of smart savings tools by Ally Bank presents disruptive innovation opportunities in the financial technology sector, enabling the development of innovative solutions for personal finance management and automated saving.

5.7

Score

Popularity

Activity

Freshness