Apple Card Family Enables Up to Five Members Per Account

Michael Hemsworth — April 22, 2021 — Lifestyle

References: apple & geeky-gadgets

Apple Card Family has been announced by the tech brand as its latest update to its namesake credit card service that will open up accounts to more members to share financial capabilities. The service will allow up to five family members to be added under one unified account to help everyone build credit and manage spending together. Members must be family members at least 13 years of age.

Apple Card Family was explained further by Vice President of Apple Pay Jennifer Bailey who said, "We designed Apple Card Family because we saw an opportunity to reinvent how spouses, partners, and the people you trust most share credit cards and build credit together. There’s been a lack of transparency and consumer understanding in the way credit scores are calculated when there are two users of the same credit card, since the primary account holder receives the benefit of building a strong credit history while the other does not. Apple Card Family lets people build their credit history together equally.”

Apple Card Family was explained further by Vice President of Apple Pay Jennifer Bailey who said, "We designed Apple Card Family because we saw an opportunity to reinvent how spouses, partners, and the people you trust most share credit cards and build credit together. There’s been a lack of transparency and consumer understanding in the way credit scores are calculated when there are two users of the same credit card, since the primary account holder receives the benefit of building a strong credit history while the other does not. Apple Card Family lets people build their credit history together equally.”

Trend Themes

1. Family Credit Card Sharing - Creating shared credit accounts within families presents an opportunity to innovate the ways credit scores are calculated for multiple users.

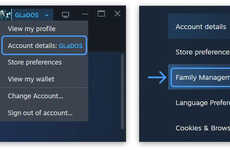

2. Financial Inclusivity - Opening up credit card accounts to a wider audience, including young people aged 13 or older, would enhance diversification and financial inclusivity by encouraging financial responsibility among family members.

3. Credit Sharing Services - The emergence of credit-card-sharing services presents an opportunity for innovative products that blend financial education, transparency, and individuals' financial goals.

Industry Implications

1. Financial Services - The financial services industry, specifically banks, could innovate by creating credit-card-sharing features (similar to Apple Card) to better serve families that want to build credit histories together.

2. Technology - There is an opportunity for technology companies to build platforms that accommodate shared credit accounts for families and provide financial literacy tools for members to improve their credit scores.

3. Education - Educational institutions could develop financial literacy programs around familial credit-card-sharing practices, thereby equipping young people with essential skills in managing their finances early on.

1.1

Score

Popularity

Activity

Freshness