WealthAssistant is a ChatGPT-Powered Tool for Any Level of Financial Literacy

Ellen Smith — June 21, 2024 — Tech

References: wealthassistant.app

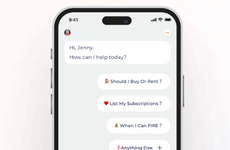

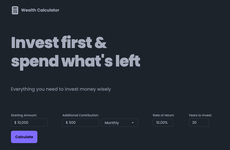

WealthAssistant is a groundbreaking financial planning tool powered by ChatGPT, designed to help users plan their financial future with ease. This beginner-friendly, goal-oriented assistant offers personalized financial advice without the intrusion of ads or cookies, ensuring a secure and private experience. By leveraging advanced AI technology, WealthAssistant simplifies the often complex world of financial planning, making it accessible to everyone, regardless of their financial literacy.

In today’s fast-paced world, managing finances can be daunting. WealthAssistant aims to demystify financial planning, providing clear and actionable steps towards achieving financial goals. From budgeting and saving to investment strategies, this tool offers comprehensive support tailored to individual needs.

WealthAssistant represents the future of personal finance, empowering users to take control of their financial destinies with confidence and ease.

Image Credit: WealthAssistant

In today’s fast-paced world, managing finances can be daunting. WealthAssistant aims to demystify financial planning, providing clear and actionable steps towards achieving financial goals. From budgeting and saving to investment strategies, this tool offers comprehensive support tailored to individual needs.

WealthAssistant represents the future of personal finance, empowering users to take control of their financial destinies with confidence and ease.

Image Credit: WealthAssistant

Trend Themes

1. AI-powered Financial Tools - Advanced AI algorithms are transforming the landscape of financial planning, making sophisticated tools accessible to a broader audience.

2. Personalized Financial Advice - Software equipped with AI offers uniquely tailored financial recommendations, enhancing personal investment strategies for users.

3. Privacy-focused Financial Solutions - Digital financial tools that prioritize user privacy are gaining traction, providing secure, ad-free experiences.

Industry Implications

1. Financial Technology - The FinTech industry is at the forefront of integrating AI to deliver high-quality, individualized financial services.

2. Personal Finance Management - Personal finance platforms are increasingly leveraging AI to simplify budgeting, saving, and investing processes for users.

3. Artificial Intelligence - AI innovations are rapidly advancing, contributing to more intuitive and effective financial management tools.

5.6

Score

Popularity

Activity

Freshness