WeFIRE Uses AI To Provide Tailored Guidance Through Complex Finances

Ellen Smith — July 17, 2024 — Tech

References: wefire.io

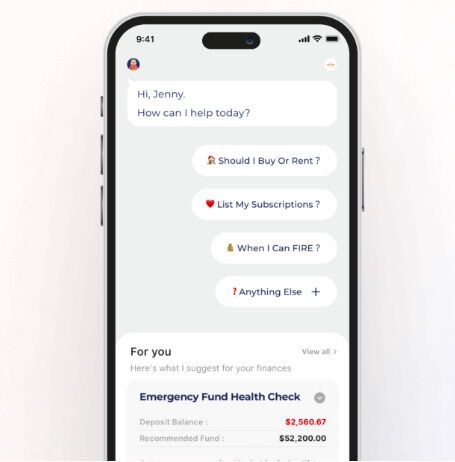

WeFIRE is an innovative personal finance tool that leverages AI to act as your very own CFO, guiding you through complex financial decisions with ease.

Whether you're contemplating whether to rent or buy your next home or identifying unnecessary subscriptions to cancel, WeFIRE provides tailored advice to optimize your financial well-being. By speaking directly to the AI, users receive personalized recommendations and actionable insights, making managing personal finances more accessible and less daunting. WeFIRE's intelligent algorithms analyze your financial data, track spending patterns, and suggest strategic moves to enhance your financial health. Ideal for anyone seeking to make smarter financial choices without the hassle, WeFIRE transforms financial management into a streamlined, efficient, and user-friendly experience.

Image Credit: WeFIRE

Whether you're contemplating whether to rent or buy your next home or identifying unnecessary subscriptions to cancel, WeFIRE provides tailored advice to optimize your financial well-being. By speaking directly to the AI, users receive personalized recommendations and actionable insights, making managing personal finances more accessible and less daunting. WeFIRE's intelligent algorithms analyze your financial data, track spending patterns, and suggest strategic moves to enhance your financial health. Ideal for anyone seeking to make smarter financial choices without the hassle, WeFIRE transforms financial management into a streamlined, efficient, and user-friendly experience.

Image Credit: WeFIRE

Trend Themes

1. AI-augmented Financial Advisory - AI-powered tools like WeFIRE offer personalized financial guidance, revolutionizing how individuals approach and manage their finances.

2. Voice-activated Financial Management - The use of voice interaction for financial advice allows users to easily communicate with AI, making complex financial concepts and decisions more accessible.

3. Subscription Optimization Tools - Tools that identify and manage unnecessary subscriptions enable users to streamline their expenses and improve overall financial health.

Industry Implications

1. Personal Finance - AI-driven financial tools are transforming personal finance management by providing tailored and actionable advice.

2. Financial Technology (fintech) - Innovations in FinTech leverage AI to offer more intuitive and efficient financial solutions to consumers.

3. Artificial Intelligence - The integration of AI in everyday financial tools exemplifies the growing role of artificial intelligence in enhancing decision-making processes.

6.1

Score

Popularity

Activity

Freshness