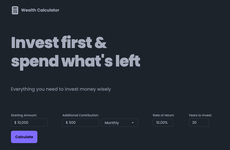

Wait For Wealth is a Tool For Practicing Investing

Ellen Smith — February 29, 2024 — Lifestyle

References: waitforwealth

Wait for Wealth introduces a playful twist to investing with its compound interest calculator, aiming to ignite enthusiasm and motivation among users to explore investment opportunities. By simply entering basic information, users can visualize their financial growth over time and see how it translates into tangible items they could purchase.

This interactive approach not only educates users about the power of compound interest but also makes investing more accessible and relatable. Wait for Wealth serves as a valuable tool to engage individuals who may have been hesitant or intimidated by traditional investment methods, ultimately encouraging them to take the first step towards financial growth and wealth accumulation. This innovative tool signifies a shift towards more interactive and user-friendly investment platforms, reflecting a growing trend of democratizing access to financial education and empowering individuals to take control of their financial futures.

Image Credit: Wait for Wealth

This interactive approach not only educates users about the power of compound interest but also makes investing more accessible and relatable. Wait for Wealth serves as a valuable tool to engage individuals who may have been hesitant or intimidated by traditional investment methods, ultimately encouraging them to take the first step towards financial growth and wealth accumulation. This innovative tool signifies a shift towards more interactive and user-friendly investment platforms, reflecting a growing trend of democratizing access to financial education and empowering individuals to take control of their financial futures.

Image Credit: Wait for Wealth

Trend Themes

1. Interactive Investment Tools - Innovative platforms are leveraging gamified features to engage users in exploring investment opportunities in a playful manner.

2. Accessible Financial Education - A trend is emerging where tools like Wait for Wealth aim to demystify investing and make financial growth more relatable for individuals.

3. User-friendly Investment Platforms - The evolution of investment tools towards greater interactivity and user-friendliness is reshaping how individuals engage and take control of their financial futures.

Industry Implications

1. Financial Technology (fintech) - Fintech companies have the opportunity to disrupt the traditional investment landscape by developing interactive tools that simplify and gamify the investing experience.

2. Personal Finance - The personal finance industry can tap into the trend of accessible financial education tools to empower individuals to make informed decisions about their wealth management.

3. Digital Wealth Management - The digital wealth management sector stands to benefit from user-friendly investment platforms that cater to a broader audience by making complex financial concepts more approachable and engaging.

1.8

Score

Popularity

Activity

Freshness