Wealthsimple is a Service That Makes Investing Quite Accessible

References: wealthsimple

Many aren't confident with their experience in financial matters and Wealthsimple — a user-friendly investment platform, seeks to change that through "powerful technology and human advice."

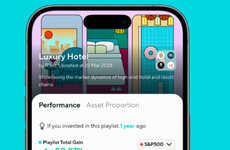

Without a doubt, a promising combination, the service specializes in custom-built, zero-maintenance portfolios. Individuals who opt-in for Wealthsimple are able to invest on autopilot, with a safety net of expert advisors who work extensively to meet individual goals. The features include auto-deposits, instant dividend reinvesting, automatic rebalancing with reference to market changes, as well as easy access for account management via Wealthsimple's "award-winning website and mobile app."

The user-friendly investment service diversifies market engagement by user-selected risk levels and investments "across the entire stock market using Exchange Traded Funds (ETFs)."

Without a doubt, a promising combination, the service specializes in custom-built, zero-maintenance portfolios. Individuals who opt-in for Wealthsimple are able to invest on autopilot, with a safety net of expert advisors who work extensively to meet individual goals. The features include auto-deposits, instant dividend reinvesting, automatic rebalancing with reference to market changes, as well as easy access for account management via Wealthsimple's "award-winning website and mobile app."

The user-friendly investment service diversifies market engagement by user-selected risk levels and investments "across the entire stock market using Exchange Traded Funds (ETFs)."

Trend Themes

1. User-friendly Investment Platforms - Wealthsimple is leading the way in making investing accessible with its user-friendly investment platform.

2. Custom-built Portfolios - The growing demand for custom-built, zero-maintenance portfolios presents a disruptive innovation opportunity in the investment industry.

3. Robo-advisors - The combination of powerful technology and human advice offered by robo-advisors like Wealthsimple represents a disruptive innovation opportunity in the financial services sector.

Industry Implications

1. Financial Technology (fintech) - The rise of user-friendly investment platforms like Wealthsimple is disrupting the FinTech industry.

2. Investment Services - The adoption of user-friendly investment platforms is transforming the investment services industry by making investing more accessible.

3. Mobile Applications - The development of user-friendly investment platforms' mobile apps is reshaping the mobile applications industry by providing convenient access to investment management.

1.8

Score

Popularity

Activity

Freshness