SigFig Wealth Management Simplified Portfolio-Tracking

Mishal Omar — November 21, 2017 — Tech

References: itunes.apple

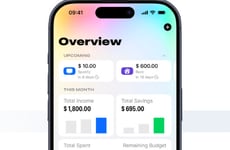

SigFig Wealth Management is an app that allows people to view their portfolio, and where it is in terms of the users' personal goals.

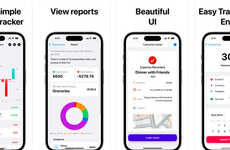

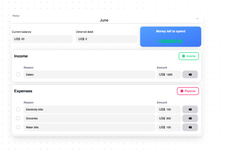

The app is described as a "data-driven financial planner" which gives users a free portfolio analysis and investment tracking upon signing up, and places all of users' investment accounts into a single dashboard so they can analyze it themselves and create a "personalized investment strategy." The app also allows users to optimize their returns by offering "24/7 portfolio monitoring, tax-efficient investment strategies, dividend reinvestment and automatic re-balancing."

SigFid Wealth Management has the benefit of organization and efficiency, as well as of being cost-effective – making it an excellent platform for people to manage their finances and investments.

The app is described as a "data-driven financial planner" which gives users a free portfolio analysis and investment tracking upon signing up, and places all of users' investment accounts into a single dashboard so they can analyze it themselves and create a "personalized investment strategy." The app also allows users to optimize their returns by offering "24/7 portfolio monitoring, tax-efficient investment strategies, dividend reinvestment and automatic re-balancing."

SigFid Wealth Management has the benefit of organization and efficiency, as well as of being cost-effective – making it an excellent platform for people to manage their finances and investments.

Trend Themes

1. Data-driven Financial Planning - There's a need to develop more data-driven financial planning software that offers free portfolio analysis and investment tracking.

2. Unified Dashboard for Investment Accounts - More unified dashboard apps are needed that can place all investment accounts in one place for people to analyze assets and create a personalized investment strategy.

3. 24/7 Portfolio Monitoring and Optimization - Software developers can create more online platforms that allow for 24/7 portfolio monitoring, tax-efficient investment strategies, dividend reinvestment and automatic re-balancing.

Industry Implications

1. Financial Services - Financial services industry can partner with tech developers to create more online wealth-tracking platforms to provide a data-driven financial planning service.

2. Investment Management - Investment management firms can benefit from creating unified dashboard apps for investment accounts to provide cost-effective solutions for portfolio analysis and investment tracking.

3. Fintech - Fintech startups can leverage data analytics and machine learning algorithms to develop more robust, free-to-use wealth management and personalized investment planning software with 24/7 portfolio monitoring and optimization.

2.2

Score

Popularity

Activity

Freshness