'Tendi AI' is a Personalized Tool Developed by Finance Experts

Colin Smith — May 6, 2024 — Tech

References: tendi.ai

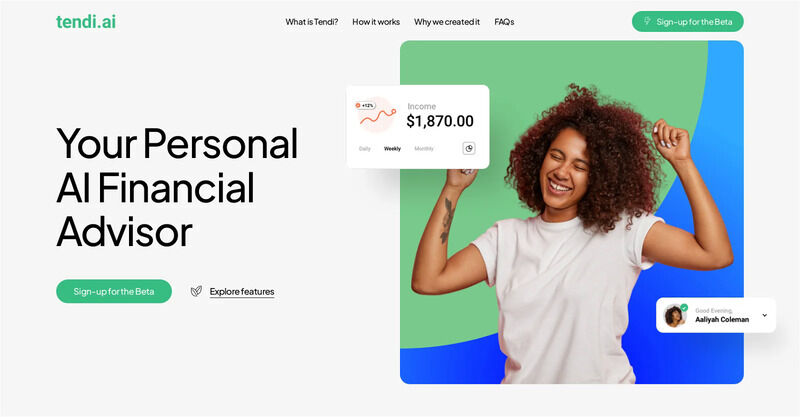

Tendi AI is an innovative financial advisor platform designed to democratize access to financial guidance. Developed by a team with backgrounds from Netflix, Roku, and Paramount+, as well as experts in economics and finance, Tendi aims to bridge the wealth gap and empower individuals with tools for a better financial future. The platform offers assistance in setting financial goals, planning, budgeting, and achieving milestones such as debt reduction, emergency fund creation, savings growth, wise investment, and retirement planning. Tendi operates on the principle that personal financial advisors should not be exclusive to the affluent; instead, it strives to provide financial empowerment to all users.

The platform’s functionality is unique as it does not require linking bank accounts, allowing users to input estimated income, expenses, debts, and investments manually. However, connecting online banking can enhance the accuracy and effectiveness of the financial plans generated by Tendi. Security is a priority for Tendi, which employs advanced encryption and strict privacy protocols to protect user data. Continuous monitoring and updates are part of its commitment to safeguarding against digital threats. Tendi is accessible to both beginners and seasoned financial enthusiasts, offering a user-friendly interface and educational resources to bolster financial literacy and confidence.

Image Credit: Tendi

The platform’s functionality is unique as it does not require linking bank accounts, allowing users to input estimated income, expenses, debts, and investments manually. However, connecting online banking can enhance the accuracy and effectiveness of the financial plans generated by Tendi. Security is a priority for Tendi, which employs advanced encryption and strict privacy protocols to protect user data. Continuous monitoring and updates are part of its commitment to safeguarding against digital threats. Tendi is accessible to both beginners and seasoned financial enthusiasts, offering a user-friendly interface and educational resources to bolster financial literacy and confidence.

Image Credit: Tendi

Trend Themes

1. Personalized AI Finance Tools - Revolutionize traditional finance models through AI-driven personalization to expand access and offer tailored financial guidance.

2. Wealth Empowerment Platforms - Transform financial services by empowering individuals of all socio-economic backgrounds with tools for achieving long-term financial well-being.

3. Banking Security Innovations - Enhance financial security measures in digital banking platforms through advanced encryption and privacy protocols while prioritizing user data protection.

Industry Implications

1. Fintech - Fintech companies can leverage AI technology to provide personalized financial solutions to a broader user base beyond the traditional affluent client segment.

2. Personal Finance - The personal finance industry has an opportunity to revolutionize financial planning by offering accessible tools for setting and achieving financial goals.

3. Cybersecurity - Cybersecurity firms can explore partnerships with financial platforms to enhance data protection and develop advanced encryption protocols to safeguard user information.

7.6

Score

Popularity

Activity

Freshness