PennyFlo Streamlines Financial Management for Businesses

Ellen Smith — January 29, 2024 — Business

References: pennyflo.io

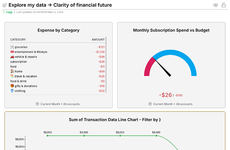

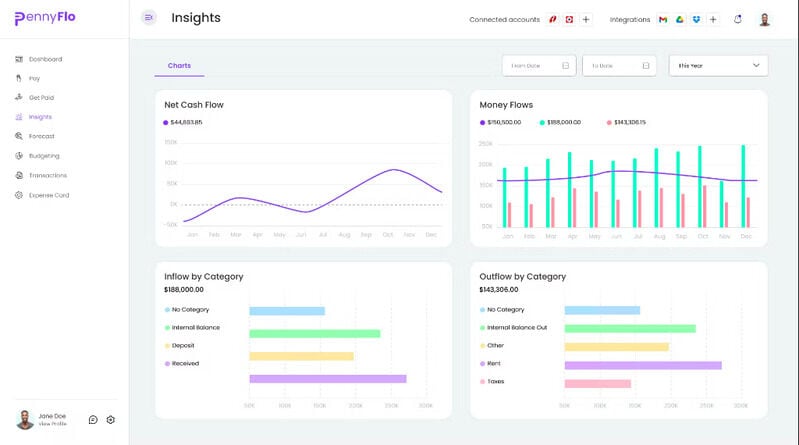

In today's fast-paced business world, staying organized and on top of finances is crucial for success, which is why PennyFlo, an all-inclusive SaaS tool for banking, forecasting, and cash control, should appeal to business owners and startups. By centralizing banking, credit cards, and accounting software, PennyFlo streamlines financial management, allowing CFOs and directors to work seamlessly with their finance teams.

With 80% task automation, PennyFlo saves time and effort, freeing up employees to focus on strategic initiatives. This finance suite offers a comprehensive solution for businesses to forecast cash flow, control expenses, and make informed financial decisions. By embracing PennyFlo, businesses can stay ahead of the curve, improve efficiency, and ensure financial stability, ultimately driving growth and success in today's competitive landscape.

Image Credit: PennyFlo

With 80% task automation, PennyFlo saves time and effort, freeing up employees to focus on strategic initiatives. This finance suite offers a comprehensive solution for businesses to forecast cash flow, control expenses, and make informed financial decisions. By embracing PennyFlo, businesses can stay ahead of the curve, improve efficiency, and ensure financial stability, ultimately driving growth and success in today's competitive landscape.

Image Credit: PennyFlo

Trend Themes

1. Centralized Financial Management - PennyFlo streamlines financial management by centralizing banking, credit cards, and accounting software, saving time and effort.

2. Task Automation - With 80% task automation, PennyFlo frees up employees to focus on strategic initiatives, improving efficiency.

3. Comprehensive Finance Solutions - PennyFlo offers a comprehensive solution for businesses to forecast cash flow, control expenses, and make informed financial decisions, ensuring financial stability.

Industry Implications

1. Banking - PennyFlo's centralized financial management tool disrupts the banking industry by streamlining financial processes and improving efficiency.

2. Accounting - PennyFlo's task automation capabilities disrupt the accounting industry by freeing up employees to focus on strategic initiatives instead of manual tasks.

3. Financial Technology - PennyFlo's comprehensive finance solutions disrupt the financial technology industry by providing businesses with the tools they need to forecast cash flow and make informed decisions.

2.5

Score

Popularity

Activity

Freshness