Bank Rakyat Indonesia Debuts the #BRImoWorldXperience

References: prnewswire

The #BRImoWorldXperience initiative by Bank Rakyat Indonesia highlights the mobile banking app's growth as a digital banking solution with a global reach. Positioned as a "super-app," BRImo integrates features that cater to both local and international banking needs. With over 38 million users by late 2024 and robust transaction values, BRImo underscores its success in driving financial digitalization.

The mobile banking app's appeal lies in its wide range of cross-border services. Users can perform international transactions, open accounts remotely using local mobile numbers, and manage foreign currency accounts with real-time conversion rates. BRImo supports over 160 countries and manages multi-currency debit cards.

To capture the attention of consumers, BRImo runs rewarding promotions such as luxury vehicle giveaways and instant prizes that add an engaging element to its marketing initiatives.

Image Credit: BRImo

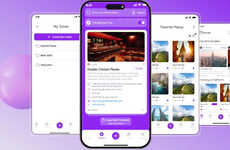

The mobile banking app's appeal lies in its wide range of cross-border services. Users can perform international transactions, open accounts remotely using local mobile numbers, and manage foreign currency accounts with real-time conversion rates. BRImo supports over 160 countries and manages multi-currency debit cards.

To capture the attention of consumers, BRImo runs rewarding promotions such as luxury vehicle giveaways and instant prizes that add an engaging element to its marketing initiatives.

Image Credit: BRImo

Trend Themes

1. Cross-border Financial Services - The rise of apps like BRImo offering cross-border services highlights an opportunity for seamless international banking experiences that were once cumbersome for users.

2. Super-app Integration - As mobile banking apps evolve into super-apps, they present a transformative way for users to manage diverse financial tasks within a single platform.

3. User Engagement Promotions - Offering unique promotions such as luxury vehicle giveaways can substantially increase customer engagement and attract new users to mobile banking solutions.

Industry Implications

1. Mobile Banking - Mobile banking continues to expand by integrating comprehensive functionalities, making traditional banking services available instantly and globally.

2. Fintech Solutions - Financial technology platforms are increasingly focusing on international reach and versatility, enabling users to manage finances in multiple currencies with ease.

3. Digital Marketing - The incorporation of excitement-driven marketing strategies in fintech apps enhances user acquisition and retention through innovative promotions.

6.9

Score

Popularity

Activity

Freshness