Nerve Launched a Digital Bank For Recording Artists

Niko Pajkovic — August 24, 2021 — Business

References: nerve.pro & businesswire

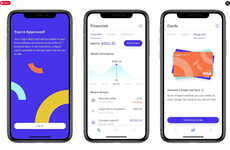

American music tech startup Nerve has announced the launch of the first-ever neobank to be designed specifically for musicians. Also titled 'Nerve', the new digital-only bank will combine user experience and financial technologies to assist recording artists in the process of launching sustainable careers.

The platform will cater to both English and Spanish-speaking musicians and will come equipped with a range of tools designed to help them plan and manage their financial futures. Features of Nerve will include FDIC-insured business debt and savings accounts, access to streaming and social media data, private networking opportunities, free instant payments to other Nerve users, and access to 55,000 free ATMs.

“Banks of days past would offer services that their local geography needed. Today, banking communities aren’t defined by rivers and railroads, but by the shared experience and goals of their customers,” said the CEO of Nerve, John Waupush.

Image Credit: Shutterstock

The platform will cater to both English and Spanish-speaking musicians and will come equipped with a range of tools designed to help them plan and manage their financial futures. Features of Nerve will include FDIC-insured business debt and savings accounts, access to streaming and social media data, private networking opportunities, free instant payments to other Nerve users, and access to 55,000 free ATMs.

“Banks of days past would offer services that their local geography needed. Today, banking communities aren’t defined by rivers and railroads, but by the shared experience and goals of their customers,” said the CEO of Nerve, John Waupush.

Image Credit: Shutterstock

Trend Themes

1. Musician-targeted Neobanks - The rise of neobanks designed to cater to a specific industry like music presents an opportunity for disruptive innovation in the financial technology sector.

2. Fdic-insured Business Accounts - The integration of FDIC-insured business accounts within neobanks enables disruptive innovation of financial services through increased financial security for small businesses in targeted industries.

3. Data-driven Financial Planning - The inclusion of features such as access to streaming and social media data presents an opportunity for disruptive innovation in the development of personalized financial planning tools for targeted industries.

Industry Implications

1. Music - The launch of musician-targeted neobanks presents an opportunity for disruptive innovation in the financial services industry catering specifically to the needs of the music industry.

2. Small Business Banking - The integration of FDIC-insured business accounts into neobanks presents an opportunity for disruptive innovation in the small business banking industry.

3. Data Analytics - The use of data-driven financial planning tools presents an opportunity for disruptive innovation in the data analytics industry focused on targeted industries.

2

Score

Popularity

Activity

Freshness