'Cashiya' Generates Accurate Reports on Your Spending Habits

Michael Hemsworth — May 16, 2018 — Lifestyle

References: cashiya.in & betalist

Getting approved for loan usually consists of the bank running a credit check and providing a general option based on the results, but the 'Cashiya' platform takes a different approach to help out consumers.

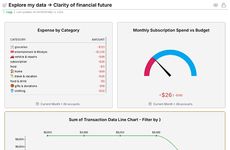

Harnessing the power of AI technology, the platform works to track user spending in real-time and generate reports that can then be used in the approval process. This enables consumers to access the best offers possible and compare them all before making a choice to ensure they have as much control over their finances as possible.

The 'Cashiya' platform also works effectively on a daily basis for tracking your spending, setting up budgets, downloading financial reports and much more to offer a holistic approach to how you handle your money.

Harnessing the power of AI technology, the platform works to track user spending in real-time and generate reports that can then be used in the approval process. This enables consumers to access the best offers possible and compare them all before making a choice to ensure they have as much control over their finances as possible.

The 'Cashiya' platform also works effectively on a daily basis for tracking your spending, setting up budgets, downloading financial reports and much more to offer a holistic approach to how you handle your money.

Trend Themes

1. AI Finance-tracking Platforms - Cashiya demonstrates the potential for AI-powered finance-tracking platforms to provide personalized financial insights.

2. Real-time Spending Tracking - The real-time spending tracking feature of Cashiya highlights the trend towards consumers wanting up-to-date information on their spending habits.

3. Holistic Financial Management - Cashiya's comprehensive platform demonstrates the importance of taking a holistic approach to personal finance management.

Industry Implications

1. Fintech - The rise of AI-powered finance-tracking platforms like Cashiya presents an opportunity for Fintech companies to offer personalized financial insights to consumers.

2. Banking - Banks can innovate and remain competitive by adopting AI technology to provide more accurate and personalized loan options to customers.

3. Personal Finance - The growth of holistic finance-tracking platforms like Cashiya reflects the trend of consumers wanting more control over their finances and seeking a personalized approach to financial management.

1.8

Score

Popularity

Activity

Freshness