True Link Financial Caters to Boomers and Retirees

Michael Hemsworth — November 21, 2016 — Life-Stages

References: truelinkfinancial & venturebeat

Being that such a large amount of the wealth in the United States is held by those 59 and over, True Link Financial is a wealth management service that caters to this prime demographic.

True Link Financial works with older individuals to help offer services and advice that is attuned to their situation that might not be as recognized or understood by other service providers.

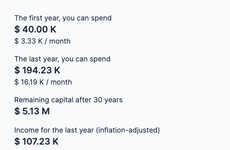

The number of wealth management services is quite high, but many of them are intended for an array of different demographics rather than being more customized. True Link Financial focuses on Boomers and retirees in order to help them save for retirement, grow that savings and spend it wisely when the time comes.

True Link Financial works with older individuals to help offer services and advice that is attuned to their situation that might not be as recognized or understood by other service providers.

The number of wealth management services is quite high, but many of them are intended for an array of different demographics rather than being more customized. True Link Financial focuses on Boomers and retirees in order to help them save for retirement, grow that savings and spend it wisely when the time comes.

Trend Themes

1. Customized Wealth Management - Disruptive innovation opportunity: Create specialized wealth management services tailored to the needs of Boomers and retirees to better address their unique financial situations and goals.

2. Retirement Savings Planning - Disruptive innovation opportunity: Develop innovative tools and resources that specifically assist Boomers and retirees in planning and optimizing their retirement savings for long-term financial stability.

3. Elderly Financial Education - Disruptive innovation opportunity: Design educational programs and platforms that provide financial literacy and guidance specifically targeted towards the older population, enabling them to make informed decisions and avoid scams or fraudulent schemes.

Industry Implications

1. Wealth Management - Disruptive innovation opportunity: Integrate advanced technology like AI and machine learning into wealth management platforms, offering personalized, data-driven financial solutions for retirees and Boomers.

2. Retirement Planning - Disruptive innovation opportunity: Combine traditional retirement planning strategies with robo-advisors or algorithmic-based systems to automate and enhance the retirement planning process for older individuals.

3. Financial Education - Disruptive innovation opportunity: Establish online platforms or mobile apps that provide interactive financial education and planning tools exclusively designed for Boomers and retirees to develop financial literacy and competency.

0.8

Score

Popularity

Activity

Freshness