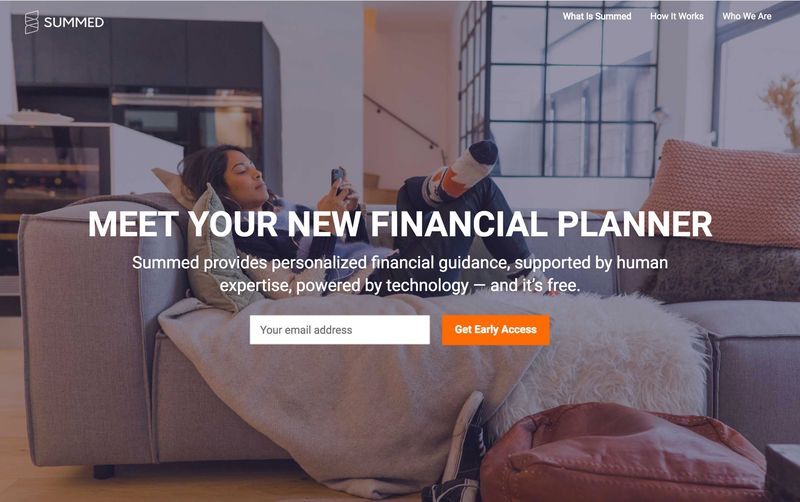

The 'Summed' Virtual Financial Planner Offers Personalized Guidance

Michael Hemsworth — November 1, 2017 — Lifestyle

'Summed' is a virtual financial planner that provides users with a way to maintain a better standing with their finances to ensure that they are using their money wisely.

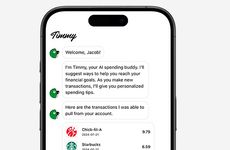

The 'Summed' platform incorporates a technology focused design yet will provide users with access to human expertise to ensure that they can navigate the market with better agility. This enables users to ask questions about what to do with extra cash, how to hit a specific financial goal in a set amount of time and much more.

The 'Summed' virtual financial planner offers unlimited advice for users that comes straight from a team of licensed financial experts to keep the focus on a more organic experience rather than utilizing AI technology.

The 'Summed' platform incorporates a technology focused design yet will provide users with access to human expertise to ensure that they can navigate the market with better agility. This enables users to ask questions about what to do with extra cash, how to hit a specific financial goal in a set amount of time and much more.

The 'Summed' virtual financial planner offers unlimited advice for users that comes straight from a team of licensed financial experts to keep the focus on a more organic experience rather than utilizing AI technology.

Trend Themes

1. Virtual Financial Planners - Disruptive innovation opportunity: Develop AI-powered financial planning platforms that offer personalized guidance.

2. Human-centric Financial Assistance - Disruptive innovation opportunity: Create platforms that combine human expertise with technology to provide users with personalized financial guidance.

3. Unlimited Financial Advice - Disruptive innovation opportunity: Build platforms that offer unlimited access to licensed financial experts for personalized financial advice.

Industry Implications

1. Fintech - Disruptive innovation opportunity: Fintech companies can create virtual financial planning platforms that offer personalized guidance.

2. Wealth Management - Disruptive innovation opportunity: Develop wealth management platforms that combine technology and human expertise to provide personalized financial assistance.

3. Online Financial Services - Disruptive innovation opportunity: Online financial service providers can offer unlimited access to licensed financial experts for personalized financial advice and guidance.

3.9

Score

Popularity

Activity

Freshness