Google Announced Virtual Credit Card Counterparts to Physical Cards

Colin Smith — May 13, 2022 — Pop Culture

References: googlecloudpresscorner & ca.style.yahoo

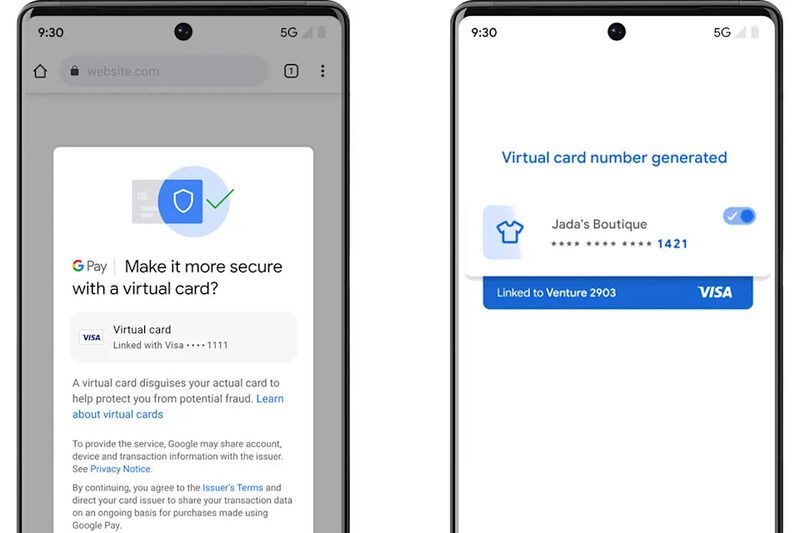

Google announced a new virtual credit card feature that is both more convenient and more secure than using physical cards online. The service allows Google to make a duplicate of a physical credit card that it stored on a Google account. This duplicate will have a separate card number, pin number, and security measures. This means that individuals who purchase items online will not have to hunt for, or memorize, their credit card number, as there will be a secure counterpart stored on their account.

The virtual card is also more secure as it is only usable by the account it is logged in to. In the event of a data breach, a physical credit card number can be stolen and used by anybody who has access to the necessary information. With these virtual credit cards, however, even in the event of a data breach, each individual's payment information will remain secure.

Image Credit: Google

The virtual card is also more secure as it is only usable by the account it is logged in to. In the event of a data breach, a physical credit card number can be stolen and used by anybody who has access to the necessary information. With these virtual credit cards, however, even in the event of a data breach, each individual's payment information will remain secure.

Image Credit: Google

Trend Themes

1. Virtual Payment Cards - The rise of virtual payment cards can lead to a paradigm shift in the way transactions are conducted online.

2. Data Security - The use of virtual payment cards highlights the growing importance of data security and presents opportunities for disruptive innovation in cybersecurity.

3. Mobile Payments - Virtual payment cards offer a glimpse into the future of mobile payments, where physical payment methods become obsolete.

Industry Implications

1. Financial Technology - The use of virtual payment cards presents a disruptive opportunity for fintech startups to develop secure and user-friendly payment solutions.

2. E-commerce - The rise of virtual payment cards could transform the e-commerce industry by providing a more secure and convenient way to make online purchases.

3. Cybersecurity - The increased focus on data security due to the use of virtual payment cards presents opportunities for cybersecurity firms to develop innovative and effective solutions to protect against data breaches.

2.5

Score

Popularity

Activity

Freshness